RFG 2012 Year End Letter, with a bit of a rant thrown in!

Happy New Year! Good Health and Happiness to You and Yours in the year ahead!

We are pleased to put 2012 in the books! Not to bid it good riddance however! Rather to mark the end of a year in which we all accomplished a great deal. We expect a year ahead with far less change to endure! It will leave us time this year to introduce to you our new capabilities and streamline our delivery of them to you. RFG moved into its own new home base. Kendra and I moved our families together early in the year, sold both of our previous homes and got married December 28th. Trevore purchased a home nearby and will be settling into it. Susan’s husband’s company has gotten a new product out after many years of painstaking effort. This year we look forward to keeping our homes and RFG in place and simply living and working in them!

With one exception, markets ended the year looking very normal, even healthy. US and Foreign Equity markets were up, in general, in the mid-teens, and debt markets as measured by Barclays Capital US or Global Aggregate Bond markets were each up just more than 4% on a total return basis. How they got there didn’t feel normal, but it truly was. There was nothing extraordinary about market action this past year. Perhaps the only unusual element to the year was the last day when US equity markets were up more than a percent (S&P 500 still down 0.4% for the quarter). At this writing, the next surprise was the huge start to this year. Globally, markets jumped 2-3% or more on 2013’s first trading day.

The exception to “normal” remains the artificially low Treasury Yield Curve, with Treasury bills held near zero interest by the Federal Reserve, as it openly fights low employment with allegedly “stimulative” ultra-low short term rates. The following was removed from our quarterly letter to clients in the interest of brevity.

Fed Chairman Bernanke is continuing “Operation Twist”; referring to the Federal Reserve initiative buying longer-term Treasuries and simultaneously selling the shorter-dated issues it already held in order to bring down long-term interest rates. The Fed is continuing to expand the balance sheet and keep and mortgage rates down via “QE3.” The Fed implements quantitative easing by creating money (exactly the same way your kids create things in their video games!) and then buying bonds or other financial assets from banks, (primarily mortgage backed securities guaranteed by Fannie Mae and Freddie Mac.) On September 13, the U.S. Federal Reserve launched its third round of quantitative easing, and officially stated - for the first time - that it would keep short-term rates low through 2015. These “operations” ARE NOT, considered spending, nor are they counted in the calculations of the federal deficit. These are “balance sheet” activities! While private debt presaged our last economic crisis; this will be our next challenge.

The private sector, (us) used an addiction to debt to create the boom that ended so disastrously in 2008. The public sector remains more addicted than ever, but it the addiction has been obscured by shifting it to the federal methadone clinic, where expanding the balance sheet is the treatment until we figure out how to get federal spending permanently below 19% of GDP (it is currently almost 23% of GDP). Interestingly, most of the spending is still on things for individuals, including everything from unemployment paychecks, other welfare payments and social programs, Medicare, social security, college aid etc. But there is plenty of spending on businesses as well. Namely tax breaks for business activities that, while appealing from an environmental, employment, or some other popular perspective aren’t economically viable on their own. All in all, most of the spending is still on things that promote the opposite of our founding principles as a nation; that we should be self-sufficient as individuals, communities, states and a nation; that we should reap the rewards of our labors or suffer the consequences of our sloth; that we should rely on our families and communities to endure misfortune, and give back to them in good fortune.

The point to all this is that all the talk about tax rates is simply not pertinent to achieving economic growth, which is the key to getting our nation back to work which is the only way to reduce deficits. The talk about the government of legislators reducing deficits is moot; they can only change our incentives and penalties. They have no control over revenues, only tax rates and those are inversely correlated to government revenues. Tax rates go up; revenues go down and vice versa. Our government can control the spending side of the equation, but with our encouragement they have chosen not to. The deficit will increase or decrease based upon the combined economic activities of every resident of our country, and upon the ability of our government to keep spending below 19% of the value of all of that activity. If you motivate and create more activity by more people, especially any activity by unemployed people, you create growth and revenues. The tipping point between economic growth and stagnation or worse is when spending exceeds 19% of GDP; no other economic measure has any substantial correlation to economic growth and low deficits or surpluses.

The “fix” to the fiscal cliff legislation that we did go over for 24 hours or so, does nothing to address the serious issues that the Fed’s monetary policy can only keep from crisis levels with duct tape and bailing wire. We need legislative action and fiscal policies to place the country on the path of growth and prosperity. So the debt party continues, for how long, who knows. Income, estate and investment tax rates have at least been established however, and without “sunsets!” Finally, a little bit of certainty to plan against!

I won’t go into the details of the “fiscal cliff” legislation here. I’ll post that to www.facebook.com/RFGInc soon.

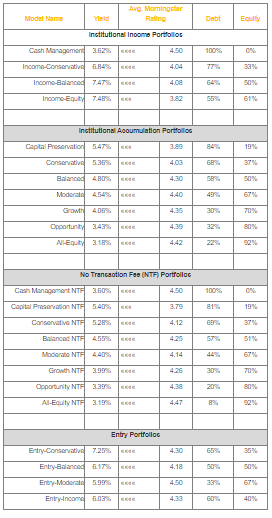

We have put a great deal of work into the design, care and feeding of our Risk Adjusted Portfolios (RAPs) over the past year. In the last month we have begun trading into substantially new security allocations for each RAP. In my analysis, the new capabilities are beginning to translate into performance. While US equity markets ended down over the last quarter, at times more than 2%, only one of our RAPs (Income Balanced, -0.3%) also suffered a loss in the quarter. All of our other RAPs beat their US, or both their US and Global benchmarks for the quarter. All but Balanced, Income-Balanced, Opportunity and All-Equity beat their US, or both their US and Global benchmarks for the year as well. In a strong year for equity returns it is difficult for our “risk managed” portfolios to keep up in our Opportunity and All-Equity portfolios. I expect that our higher risk portfolios, as well as our balanced and income oriented portfolios, will see better risk adjusted and relative performance going forward than they have in the past 2 years. Our new analytical tools and processes are giving us even better information, and doing so faster, about the risk and return characteristics of the securities and managers we use and the portfolios we design for you. We are excited about the prospects going forward.

We have broadened our offering and standardized the processes for the care and feeding of our RAPs as we have never been able to before. We have added to our solutions so as to cover investment objectives from holding cash for a short to indeterminate period, to income in retirement or emergencies, to growing and maintaining assets and purchasing power for generations to come.

*Our Risk Adjusted Portfolios and some key characteristics…

*“No Transaction Fee” and “Entry” portfolios are for accounts that trade more frequently or are smaller sized accounts for children or employees.

It is an honor and a privilege to be your trusted advisor and Wealth Management team. We work diligently every day, in your best interest, to deserve that trust and retain that privilege.

Have a Lucky 13 and live every day fully exercising your “…unalienable Rights,…Life, Liberty and the pursuit of Happiness.”

Benjamin G Baldwin III CFP®, ChFC

President