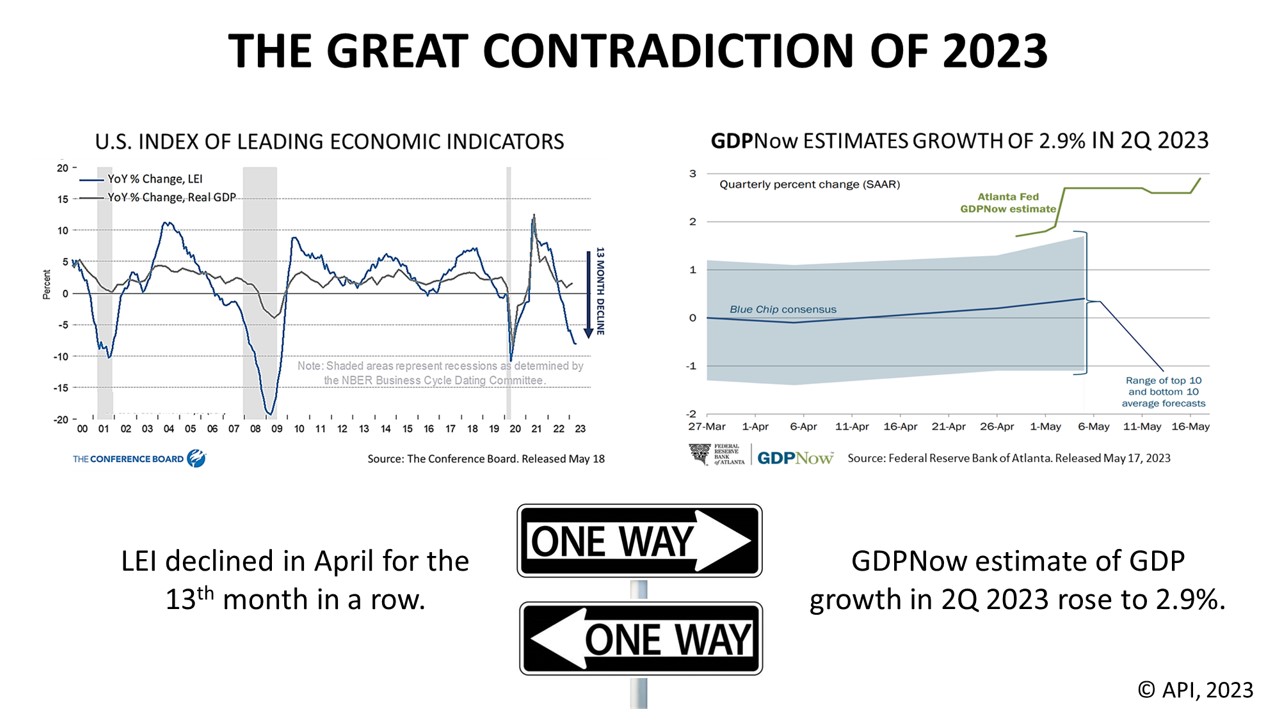

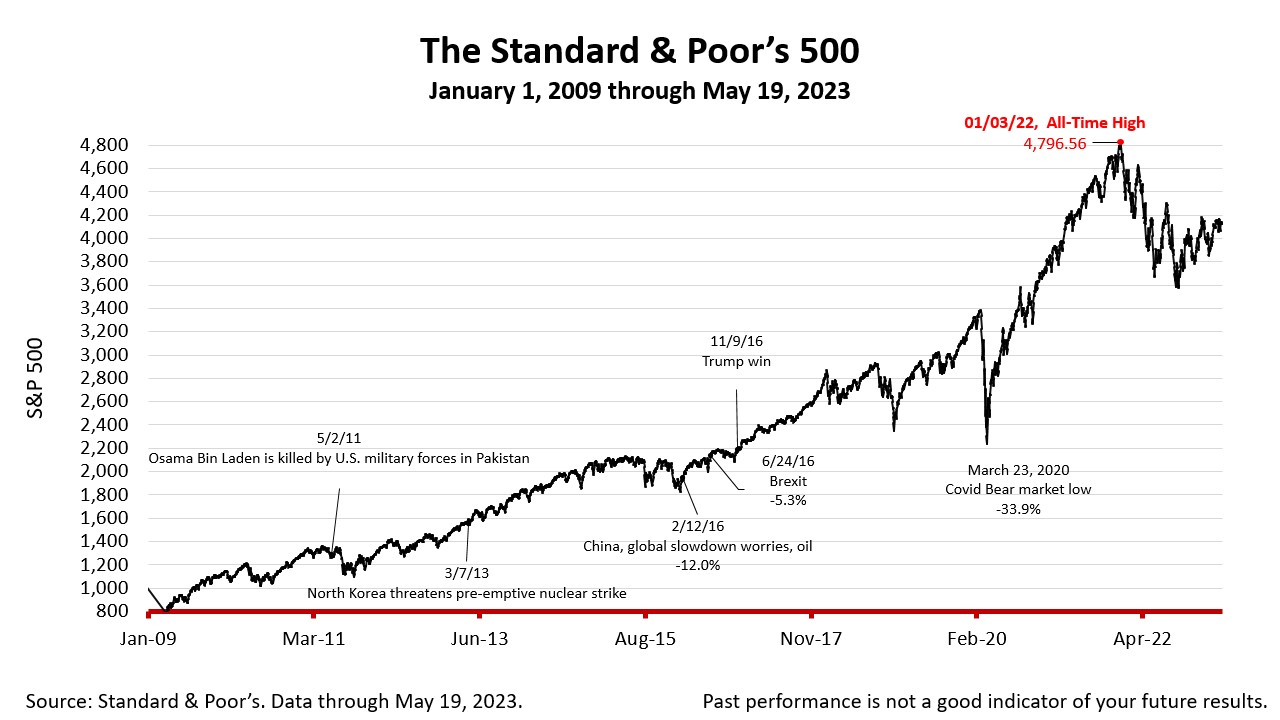

Stock investors are assuming the debt ceiling problem would be resolved. Otherwise, stocks would have plunged this past week. The major stock indexes declined Friday but were up from a week ago, as the June 1 deadline for a possible default neared. Wall Street was buoyed by positive comments from President Joe Biden about the prospects for Congress to reach an agreement on funding the federal government. While the standoff has been accurately portrayed in the press as a high-risk political drama, investors are counting on Washington to reach an agreement, so far. With the economy on the brink of a cycle of negative growth, should no agreement on the debt limit be reached in early June, brinksmanship by the Biden administration and Congressional Republicans is frightening. But the stock market performance indicates investors believe an agreement will be reached. While the financial press after Wall Street trading ended Friday said the debt-limit negotiations preoccupied the stock market all week long, we urge retirement and permanent investors to stay focused on less sensational news about underlying economic fundamentals. GDP growth drives corporate earnings. With this in mind, here is a quick view of where the economy stands.  For the 13 consecutive month, the U.S. Index of Leading Economic Indicators declined in April, signaling a slumping economy. The LEI is a reliable indicator of a recession. The Conference Board (TCB), a research and advocacy group for corporate America that maintains the widely-watched barometer, said it signals a worsening economy, repeating a prediction that a recession – two-quarters of negative GDP growth -- would begin in the current quarter, ending June 30, 2023. The LEI was released on Thursday, May 18, 2023. A day earlier, Wednesday, May 17, the GDPNow estimate of U.S. economic growth for the current quarter was updated based on an 8:30 a.m. EST housing starts report from the US Census Bureau, and strong residential investment growth lifted estimated growth to 2.9% for the quarter ending June 30, 2023. GDPNow estimate of growth is based on an algorithm by the Atlanta district branch of the U.S. Federal Reserve Bank. As new data is reported every quarter, GDPNow is updated. GDPNow is not a foolproof predictor of growth. Last quarter, it was more optimistic in its estimates of first-quarter 2023 growth, but in the previous three quarters, GDPNow’s algorithm was more accurate than human forecasters.  The Standard & Poor’s 500 stock index closed Friday at 4191.98, down -0.14% from Thursday, and up +1.65% from a week ago. The index is up +87.36% from the March 23, 2020 bear market low and down -12.60% from its January 3, 2022, all-time high. The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial situation, or particular needs. Product suitability must be independently determined for each individual investor. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |