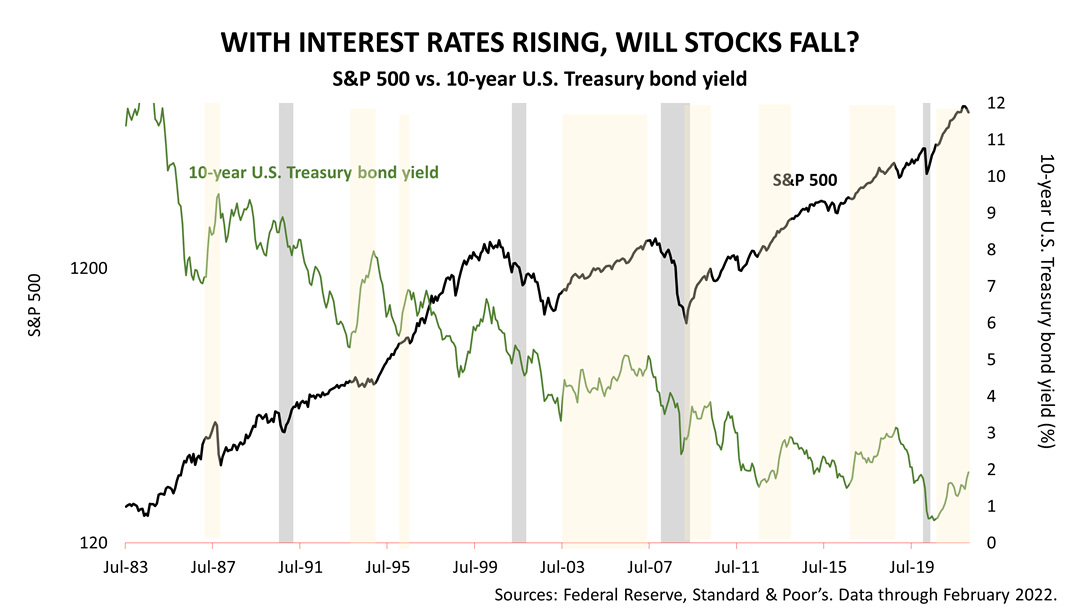

Although Russia’s atrocious war on Ukraine overshadows all other news, the genocide of Ukrainians is not the main risk to financial economic conditions. Unlike Europe, the terrible events in Ukraine impacts the U.S. economy only marginally. The main risk to the U.S. economy and stock market is not what happens in Kyiv. The main risk to the U.S. is inflation, which is running at its highest one-year rate in 40 years. Runaway inflation means higher interest rates, and the Federal Reserve just began what is expected to be the first of seven interest rate hikes in the next two years. When bond yields are higher, they become more attractive versus stocks, which draws money from stocks to bonds. Fed tightening also raises the risk of the Fed choking growth and causing a recession. The Fed has caused every recession with such policy flubs. However, that does not mean stocks cannot continue to appreciate. In fact, when interest rates are rising, it is because the economy is growing fast, and that is good for stock prices! This chart highlights in yellow the many times in recent years that stock prices rose even as the 10-year U.S. Treasury bond yield surged. A higher 10-year bond yield has been in the works since the pandemic recession ended in April 2020. The point is that stocks have often risen in the past, even when interest rates were spiking higher. The actions of the Federal Reserve system are what to watch in the months ahead. We’re all over it!

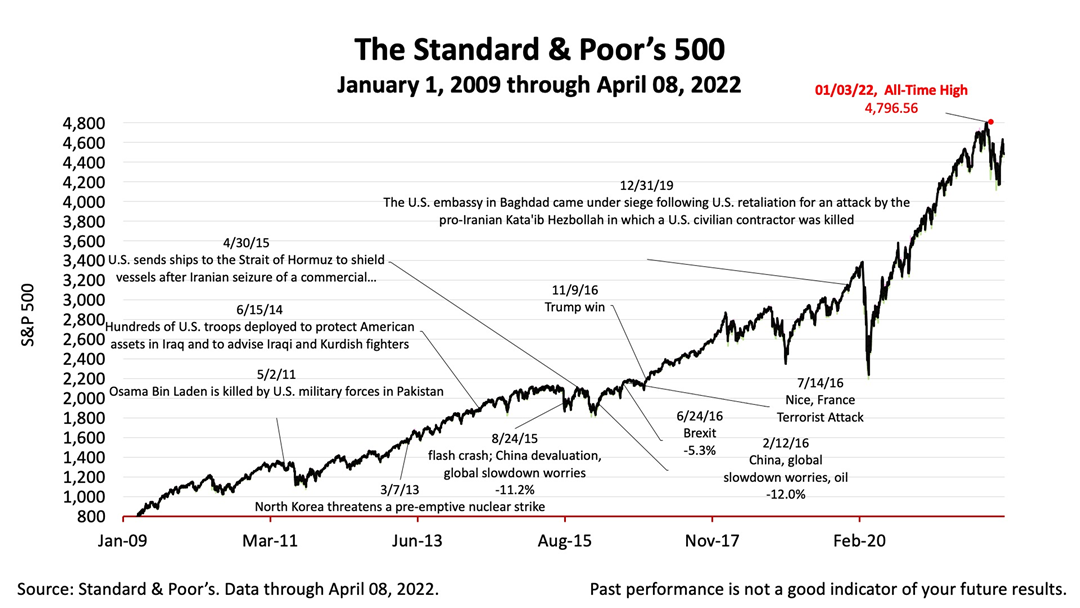

The Standard & Poor’s 500 stock index closed this Friday at 4,488.28. The index lost -0.27% from Thursday and is down -1.27% from last week. However, stocks are worth +66.93% more than the March 23, 2020, bear market low. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |