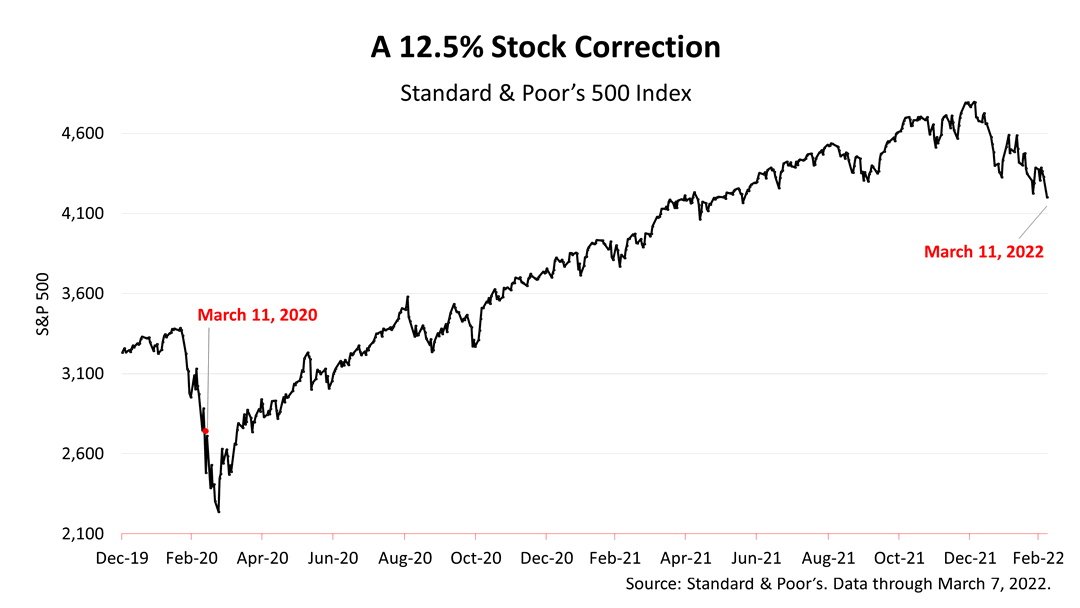

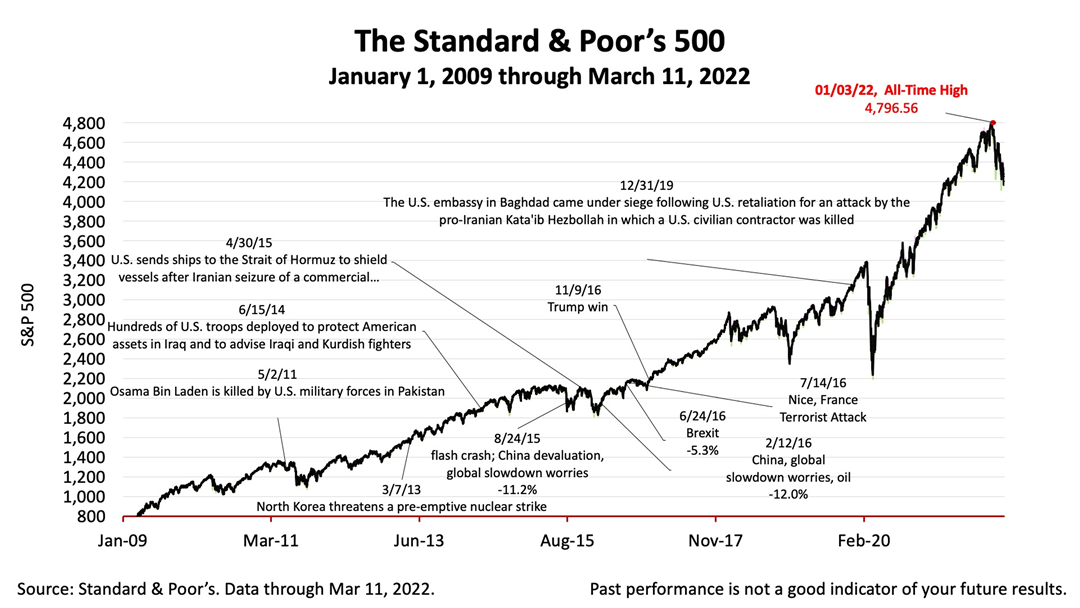

On this date two years ago, the NBA suspended its 2019-2020 season, Tom Hanks and his wife, Rita Wilson, announced they had tested positive for Covid 19, and the World Health Organization officially declared a pandemic had started. Since then, nearly one million deaths from the virus have been reported in the United States. Worldwide, six million deaths have been reported. Since then, the Covid-19 health threat to Americans has been reduced. In the years ahead, the virus is expected to pose a threat about as bad as the winter flu. The human toll, the grief and suffering, caused by the pandemic are unimaginable. The effects of the pandemic in financial terms are an entirely different matter, however, as is shown in this chart. The Standard & Poor’s 500 index, a benchmark of the largest 500 publicly traded U.S. companies, has appreciated by more than 60% since the Covid bear market low, although it has been in correction mode in recent weeks. No one can predict the stock market but we do know that stock prices are driven by earnings growth, and earnings growth is driven by economic growth. The uncertainty posed by Russia and the worst bout of inflation in 40 years is expected to continue, but the economy is expected to grow by nearly 3% in 2022, and no recession is on the horizon. Recessions trigger bear markets and that’s not what’s happening now, according to the latest fundamental economic data releases, including the: - Index of U.S. Leading Economic Indicators

- yield curve

- Federal Reserve monetary policy statement

- record high retail sales

- record low consumer financial obligations ratio

- record high household net worth

- job growth

The Standard & Poor’s 500 stock index closed this Friday at 4,204.31. The index lost -1.30% from Thursday and -2.91% from last week. The index is up +61.07% from the March 23, 2020, bear market low. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |