The total number of U.S. employees grew by 943,000 in July, a blockbuster number, and the risk of the Covid variant stopping the economic recovery grew less ominous this past week. In addition, the numbers on vaccinations improved markedly and behavioral economic factors kicked in, decreasing the likelihood that the Covid variant would end the recovery or even materially slow it down. The stock market closed at an all-time high.

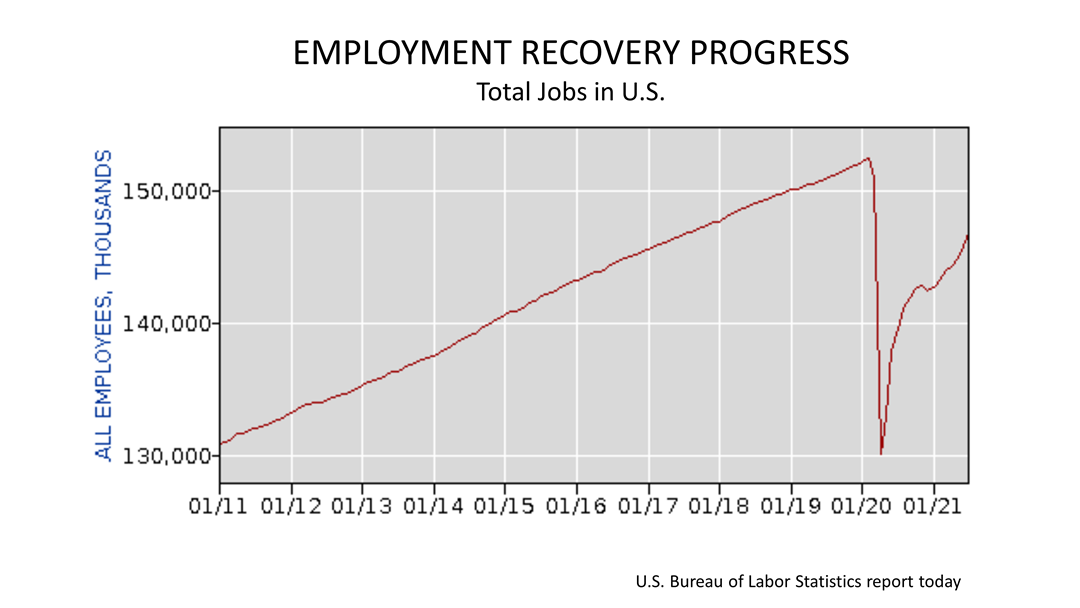

Total nonfarm payroll employment rose by 943,000 in July, and the unemployment rate declined by 0.5 percentage points to 5.4 percent, the U.S. Bureau of Labor Statistics reported today. The unemployment rate declined by one-half of a percentage point to 5.4% in July, and the number of unemployed persons fell by 782,000 to 8.7 million. These measures are down considerably from their highs at the end of the February-April 2020 recession. However, they remain well above their levels prior to the coronavirus pandemic of 3.5% and 5.7 million, respectively, in February 2020. The U.S. has recovered about 75% of the 22.4 million full-time employee positions lost at the bottom of the Covid recession of March and April 2020.

As of August 5, the seven-day average number of administered vaccine doses reported to the Center for Disease Control (CDC) per day was 699,261, a 13.6% increase from the previous week. Meanwhile, behavioral economics kicked in. “We’re going to start to see that if you want to insist on your right to be unvaccinated, you will lose some other rights,” economist Richard Thaler said in an interview on CNN earlier this week, “If you’re told you can’t work here unless you’re vaccinated, or that you can work here if you’re unvaccinated, but you have to get tested twice a week, and those tests may not be free, then I think a lot of people are going to start changing their minds.” Dr. Thaler was awarded the 2017 Nobel Prize for his work in “building a bridge between the economic and psychological analyses of individual decision-making.”

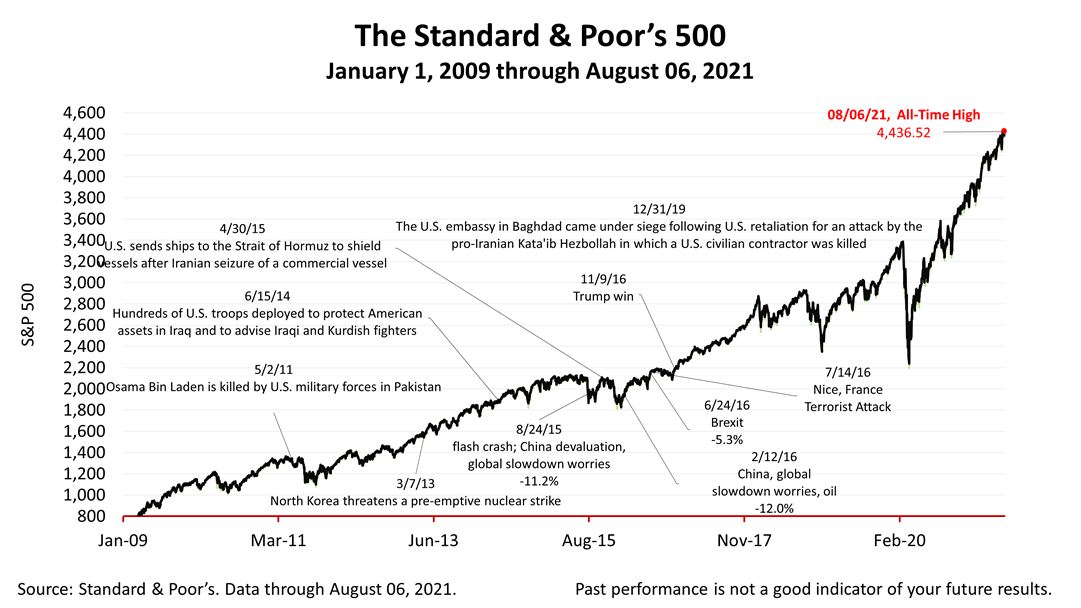

The Standard & Poor’s 500 stock index closed today at an all-time high, at 4,436.52. The index gained +0.17% from Thursday and +0.93% from last Friday’s. The index is up +65.9% from the March 23, 2020, bear market low and has been breaking records for nearly a year. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |