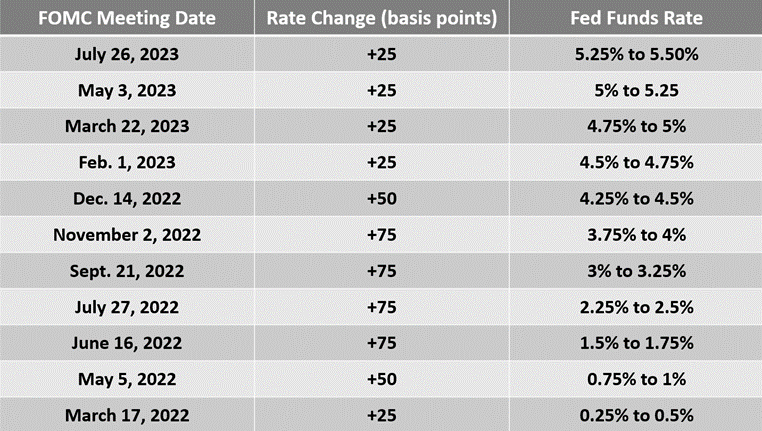

The Federal Reserve appears to be pulling off a feat most experts did not believe it could: ending its aggressive inflation-fighting campaign of 11 interest rate hikes without tipping the U.S. economy into a recession. The Covid-19 pandemic was followed by two huge federal stimulus programs and supply-chain disruptions in 2020 and 2021. Then, oil prices soared in 2022 after Russia invaded Ukraine. In response, the Fed hiked the lending rate it charges the nation’s largest banks from a quarter of 1% in March 2022 to 5.25% in July 2023. It was the most aggressive monetary tightening crusade implemented by the U.S. central bank in modern history. Inflation erodes consumer buying power and undermines confidence in an economy. Once inflation infiltrates the financial psychology of the masses, it’s hard to eradicate. The last inflation crisis, during the 1970s and early 1980s, was ended only after then-Fed chair Paul Volcker famously hiked rates so much that it caused a deep recession. The success of the Fed campaign makes it likely that the economy will not fall into a recession and will continue to grow at about a 2% rate in 2024, while inflation continues to fall toward the target rate of 2%. It demonstrates that the U.S. central banking system has grown more effective in fighting inflation and other financial economic crises, and it is a sign of the progress of the United States in solving problems. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |