As financial professionals, managing expectations about investment returns is part of our job. So, we avoid making optimistic statements about the future. But we are obliged to help investors understand the boost artificial intelligence is expected to give to the growth rate of the U.S. economy. Here’s what to know about what’s expected to happen to the U.S. economy in the years ahead.

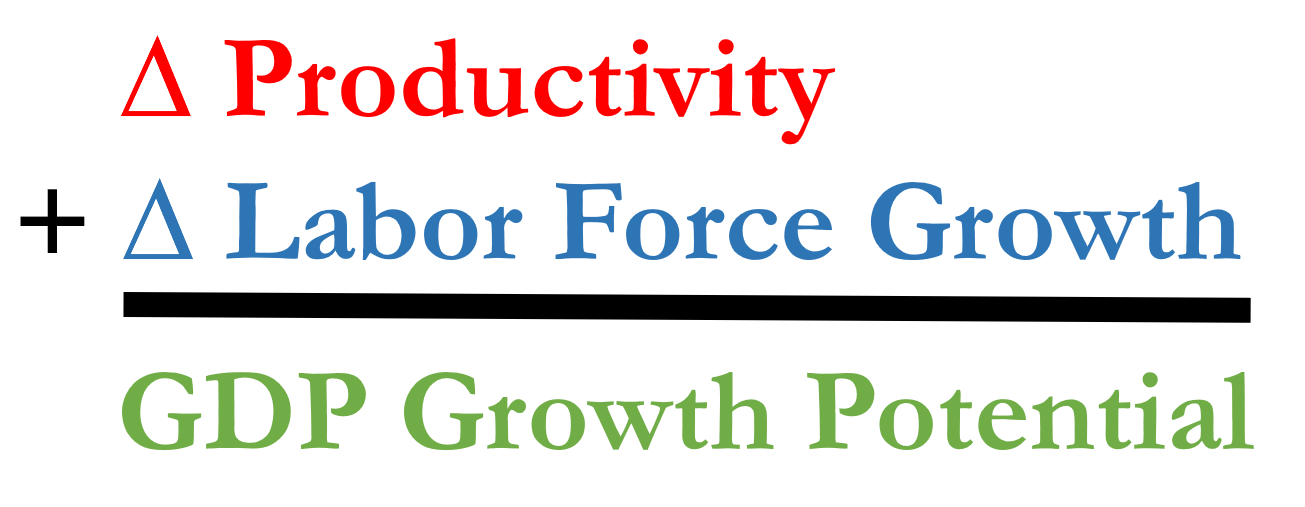

A nation’s potential growth rate – its gross domestic product growth -- is driven by simple math: The change in labor productivity plus the change in the size of the labor force determines a country’s potential gross domestic product (GDP). Because of generative AI, U.S. labor productivity, which measures how much more workers can produce for a given amount of labor, is almost certain to rise faster than expected.

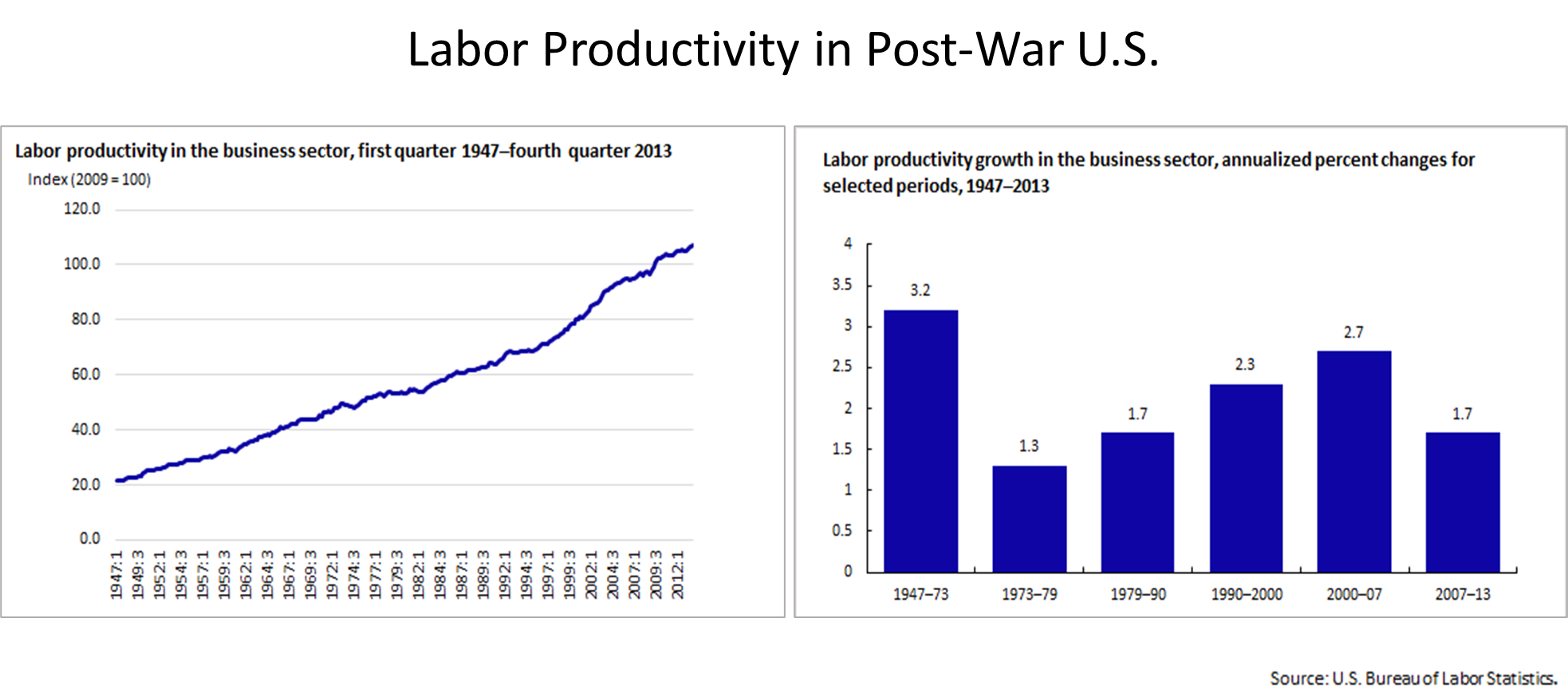

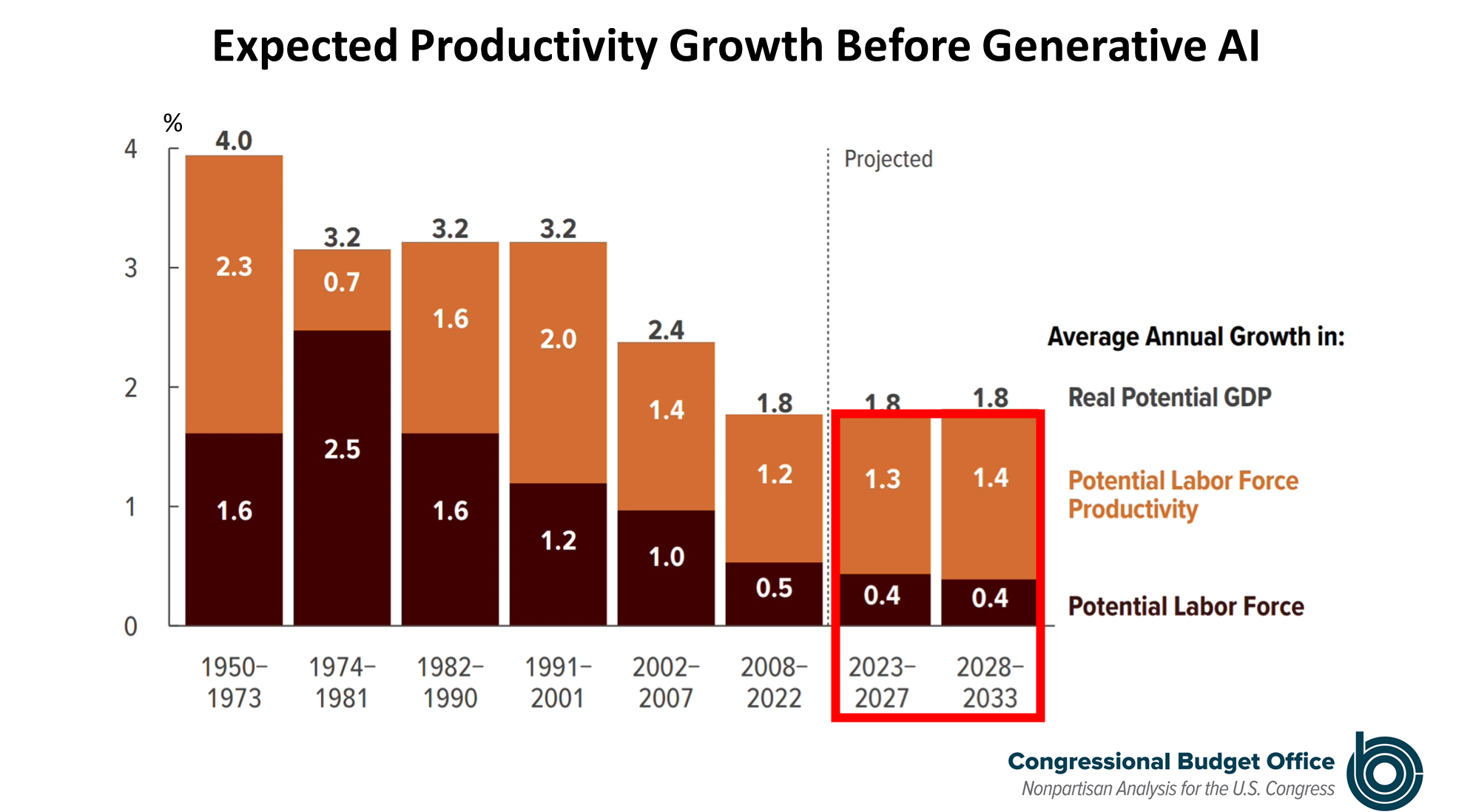

Some perspective: Labor productivity has increased steadily since the end of World War II, but bursts in productivity are discerned in the two charts below. The productivity boost that followed introduction of the internet in the 1990s is reflected in both charts. With the introduction of generative AI in February 2023 a significant boost to productivity is expected and, thus, GDP growth of the U.S is expected to be boosted. The potential growth rate of the U.S. economy in the February 2023 projection shown below, from the nonpartisan Congressional Budget Office (CBO), was pegged at 1.8% annually for the decade ending in 2033. But CBO’s projection was made before Microsoft Bing and Alphabet Google in March released AI search engine chatbots that are breakthroughs in expanding the knowledge available instantly at our fingertips.

Days after Bing and Google’s chatbots were released, Goldman Sachs, a venerable Wall Street firm, released a report projecting that widespread adoption of AI would raise US labor productivity for the next decade by 1.5% annually. To be clear, labor productivity was expected to grow by an average of nearly 1.35% annually for the next decade by CBO, but widespread adoption of AI, already under way could double the productivity of US workers in the decade ahead, according to Goldman Sachs. That permanent boost to U.S. productivity would nearly double the potential growth of the U.S. economy.

GDP growth drives corporate profit growth, and corporate profits drive stock prices higher. The point is fundamental economic factors driving stock prices could change for the better. Even if Goldman Sachs is overly optimistic in its baseline case for a 1.5% annual boost to U.S. labor productivity, a virtuous cycle of growth seems likely for the U.S -- even if AI widespread adoption takes 20 or 30 years. And if Goldman’s baseline case is on target, which seems plausible, it would drive stock prices much higher. It’s never a bad time to evaluate your portfolio but this seems like a particularly good moment for strategic investment planning. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |