Amid an information explosion, here’s evidence of why investors can trust the financial content presented here weekly. The clipping shown above is from today’s front page of The New York Times. It’s a story about China’s demographic problems. This is a story covered in December 2019 in this space. Here’s what we wrote December 11, 2019 in a weekly financial planning update article entitled, “How Worldwide Demographics Affect Your Portfolio.”

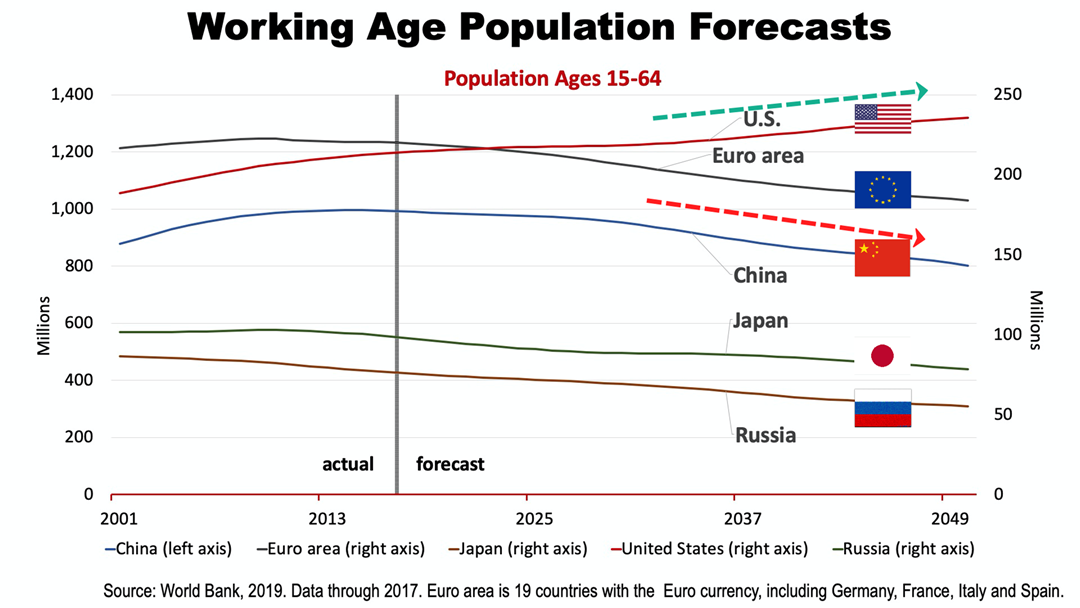

While China, Japan, Germany, and other major economies are grappling with a decline in their working-age population in the decades ahead, the U.S. working-age population is expected to grow. Since growth in the size of the labor force is one of the two determinants in economic growth, it’s a key fundamental factor that will shape the future of financial markets. This is a key fundamental affecting long-term personal financial plans. It’s important and it has practical consequences on retirement portfolios.

With the working age population stalling, Europe’s economic growth is sluggish. To stimulate the economy, Germany’s central bank has pushed lending rates into negative territory, which is unprecedented. Germany is the world’s second largest issuer of government-backed bonds and its action has depressed interest rates on U.S. Treasury Bonds. This demographic trend is set to shape growth rates in major economies across the globe for the decades ahead, which means low-rate conditions in the U.S. could persist for years. No one can predict the next move in the stock market, but demographics are fairly stable and predictable. As a result, it’s wise to be sure your strategic investment plan — specially, your portfolio’s allocations to bonds — is in sync with this key fundamental. Please call us with any questions. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |