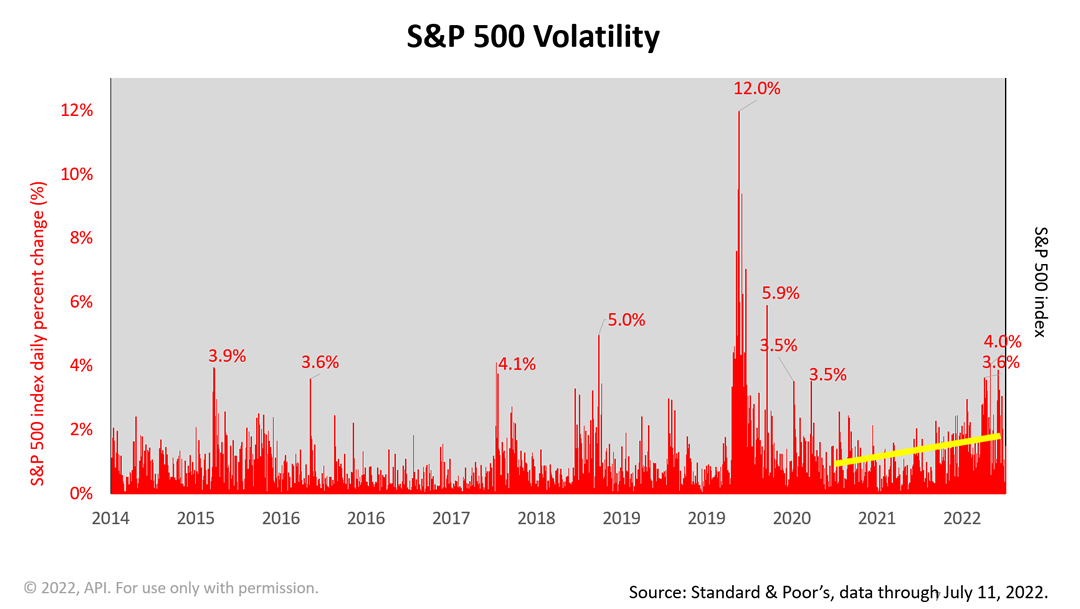

Volatility in the stock market has increased. Recently we actually hit some down days of -3.6% and -4% in the stock market. That shakes people up. But remember why you bought stocks. The basic axiom of investing in the stock market is that you deliberately looked for an asset class that was volatile. After all, if you don't own an asset class that's going to be volatile, why are you entitled to 10% long-term total return in the stock market? You're not.

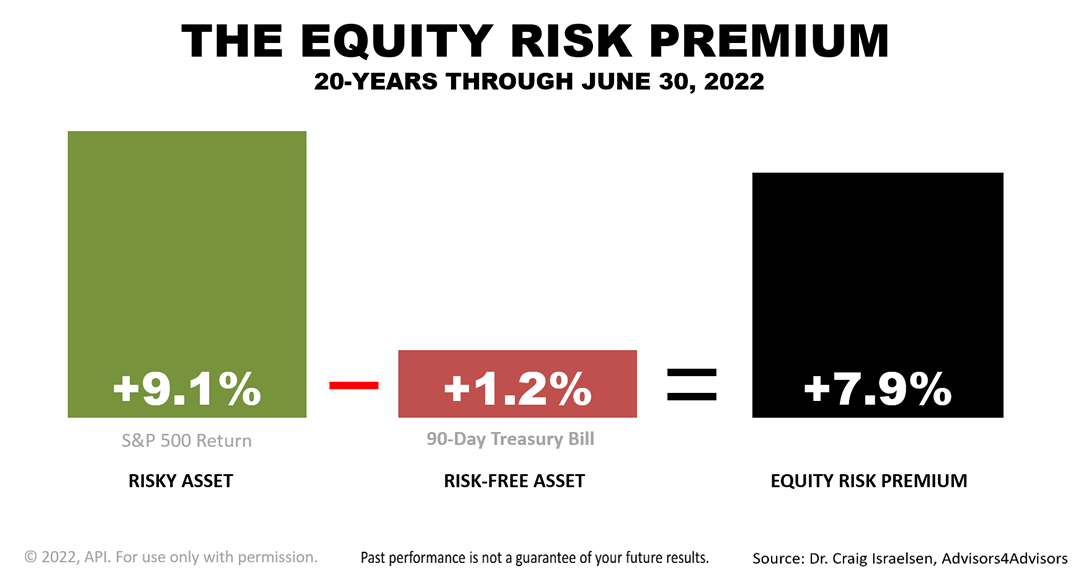

The equity risk premium, a concept in modern financial theory illustrated here, quantifies the premium stocks annually averaged in the 20 years ended June 30, 2022. Stocks, as measured by the Standard & Poor’s 500, averaged a +9.1% annual return in the 20 years -- nearly seven times the +1.2% annual return on the risk-free 90-day U.S Treasury Bill. Backed by the full faith and credit of the U.S. Government, T-Bills are considered a riskless investment. In contrast, the value of the S&P 500 index is subject to ups and downs, and, in theory, if all 500 of blue-chip companies in the S&P 500 index go bust, your entire investment could be lost. Subtracting the return on T- Bills from the return on stocks, the resulting +7.9% is the premium paid for taking the risk of owning U.S. stocks over the 20years. To be clear, investing in America’s 500 largest publicly-held companies earned an average of +7.9% more annually than a risk-free investment in the past 20 years. This 20-year period encompassed four frightening bear markets -- the tech crash of 2002, the financial crisis of 2008, the Covid downturn of early 2020 and the current bear market. Past performance is no guarantee of your future results and that, paradoxically, is precisely why investors are paid a premium for owning stocks. Yes, stocks are risky and past performance is no guarantee of your future results! Be glad for it! It is precisely why stocks have returned 7.9% more annually than U.S. Government-guaranteed investments through four bear markets and financial crises of the past 20 years. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |