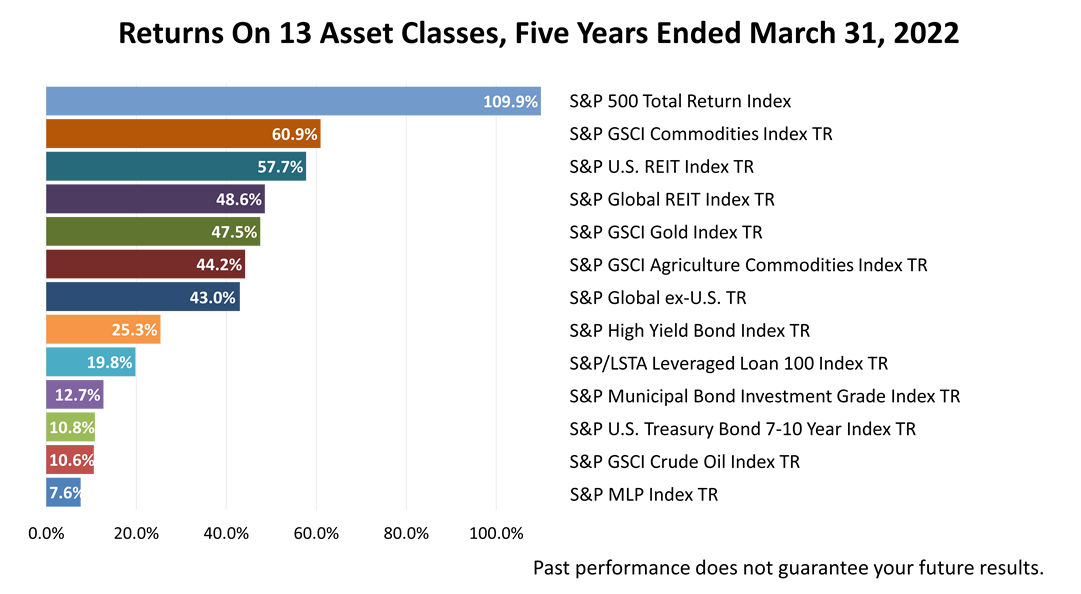

Five years is not a long time in financial planning. However, it is the shortest time-period to consider in planning a long-term portfolio that can outlive you. In America, the world’s largest and most rewarding financial economic system, building a portfolio that outlives you is the No. 1 financial goal of parents, family leaders, and charitably inclined individuals. Data in this bar chart showing five years of history should inform your outlook for investing for the rest of your life and working toward a portfolio that survives you and your spouse. This bar chart showing the returns on a broad range of 13 different types of investments, aka asset classes, is important but it is a single piece of data to analyze and understand in planning a portfolio that could provide you with income through age 90 or 95. In providing comprehensive financial planning services, return statistics for five years are important enough to tell you the major takeaways from this chart: Returns on U.S. stocks made other investments look bad. Foreign stocks returned 43% versus 110% on the Standard & Poor’s 500 stock index. While oil prices have soared since Russia invaded Ukraine, oil stocks returned 10.6%. Intermediate U.S. Government Treasury bonds returned 10.8% in the five years shown. Contact us if you’d like more information on the change in the stock market valuation paradigm. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |