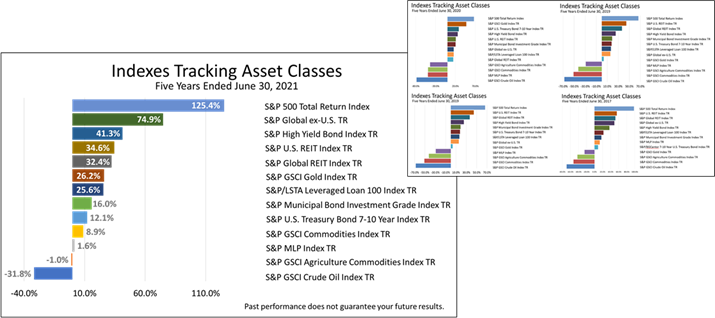

For the five years through June 30, U.S. stocks were the No. 1 performing investment of major securities indexes! The S&P 500 index more than doubled in value, despite the pandemic! Remarkably, U.S. stocks were No. 1, not only for this five-year period through June 30, 2021, but for the past FIVE five-year periods ended June 30! And today the S&P 500 closed at a record high! This is precisely the right time to ask yourself: What could go wrong?

The stock market has been treating American investors to outsized gains year after year, and the party could continue -- the good times could roll for another five years or get even better! As professionals, however, we believe it’s wise to plan for a stock market slump, to plan what you would do if things go wrong with your business, your job, or God-forbid, your health.  With the stock market and housing values sharply higher than a year ago, your net worth may be higher than ever, making this precisely the right moment to write a crisis plan. Your worst nightmare may be running out of money when you’re older, or who will care for a child with special needs after you’re gone. Or perhaps you’ve been prone to selling stocks after market plunges? With the stock market and housing values sharply higher than a year ago, your net worth may be higher than ever, making this precisely the right moment to write a crisis plan. Your worst nightmare may be running out of money when you’re older, or who will care for a child with special needs after you’re gone. Or perhaps you’ve been prone to selling stocks after market plunges?

Everyone has their own personal reactions to life’s risks, and your financial nightmare is personal to you because it’s based on your experiences and personality characteristics. Even if your financial future is looking bright at this moment, writing your crisis plan now, rather than in the throes of a crisis, can help ensure you will continue to sleep soundly even if your worst financial nightmare were to come true. Everyone has their own personal reactions to life’s risks, and your financial nightmare is personal to you because it’s based on your experiences and personality characteristics. Even if your financial future is looking bright at this moment, writing your crisis plan now, rather than in the throes of a crisis, can help ensure you will continue to sleep soundly even if your worst financial nightmare were to come true.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |