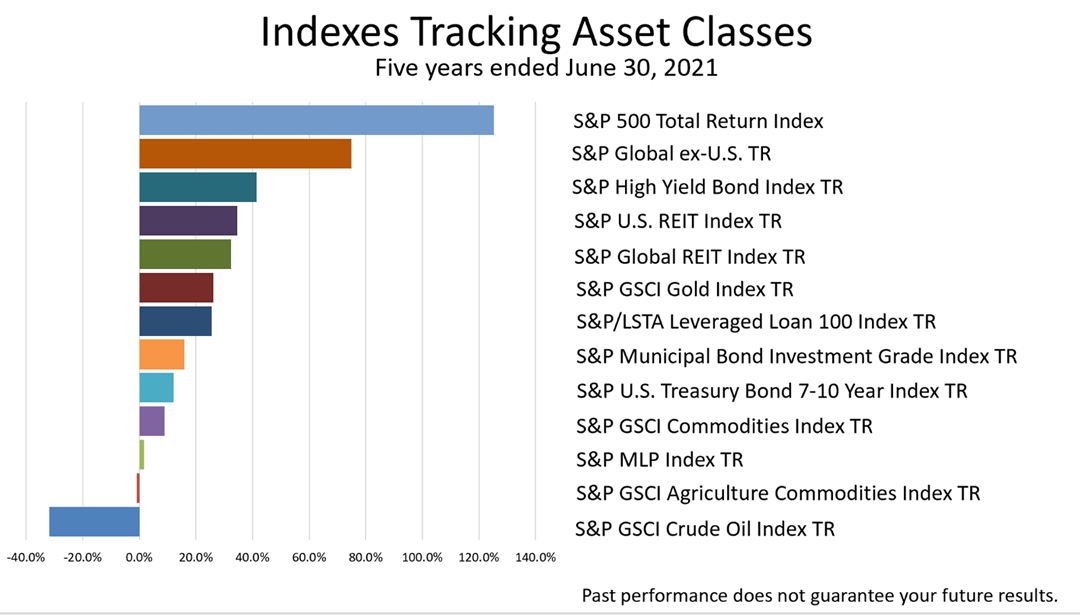

The Standard & Poor’s 500, an index representing U.S. stocks, returned 125.4% in the five years ended June 30, 2021, making it the No. 1 performer of this diverse group of 13 types of securities investments. A distant second was the 74.9% return on a global index of stocks excluding the U.S. Below is the same data, the five-year returns on the same 13 indexes, for each of the past four years ended June 30.

Remarkably, U.S. stocks were not just No. 1 for the five years ended June 30, 2021, but they were the No. 1 performer for the past five five-year periods ended June 30, 2020, 2019, 2018, and 2017!

Coming out of the first pandemic in a century, the future is uncertain, and past performance is no indication of your future investment results, but the persistent leadership of U.S. stocks is an important trend driven by financial economic conditions. This is one of the highlights in a detailed quarterly report we will send you free upon request. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |