For nearly a decade, the Federal Reserve was consistently wrong about inflation because inflation is hard to predict. Now financial cable TV stations are stoking inflation fears. Here are key historic and current facts about inflation to consider when you hear the scary inflation talking heads on TV.

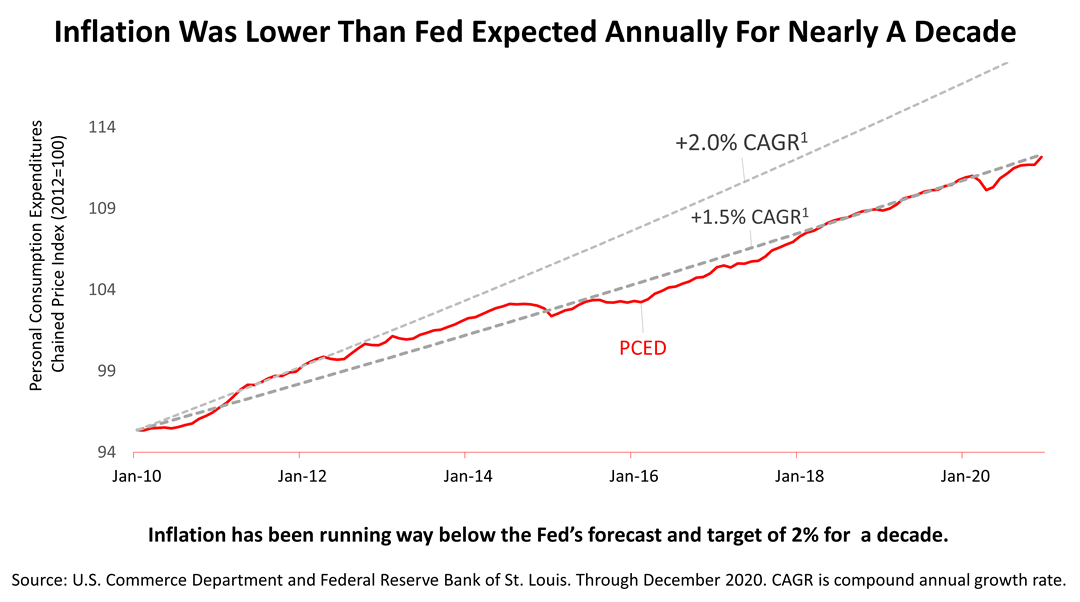

Led by Ben Bernnke, Janet Yellen, and in the early tenure of current chairman Jerome Powell, the central bank every year steadfastly forecast that inflation would rise to 2%, and every year from 2010 to 2018, the Fed was wrong. In 2018, the Fed inverted the yield curve fearing inflation and nearly caused a recession in 2019. After that, the Fed lowered rates repeatedly and abandoned its 2% forecast for inflation.

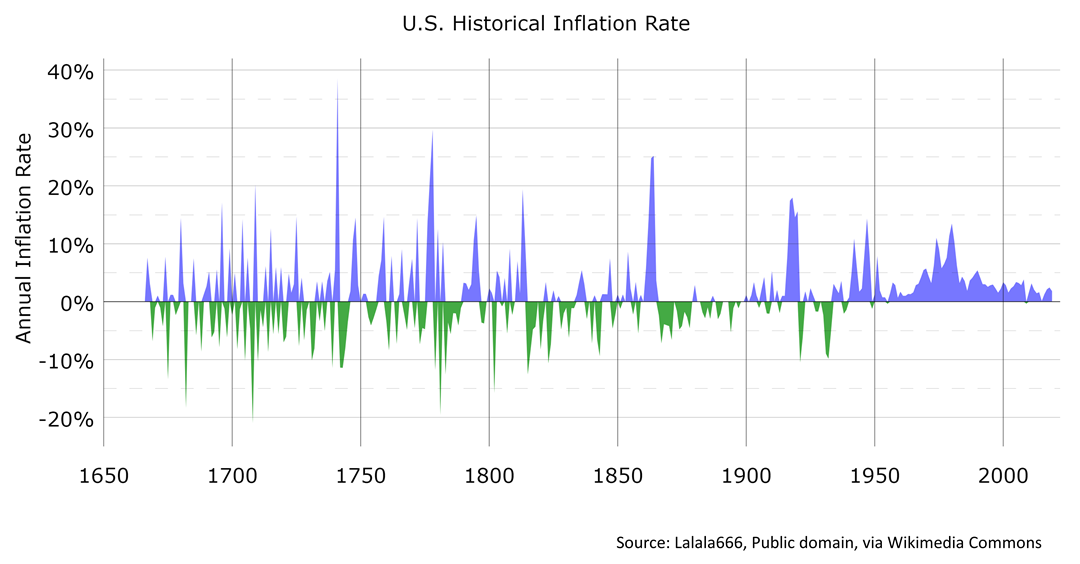

The U.S. over the decades – stretching back for the last 150 years – mostly experienced an annual inflation rate of 2% to 3%, until the spike in the mid- and late-1970s. The inflation pressures of the 1970s are not present now and current trends in the world are anti-inflationary.

For example, Amazon’s business model has reduced prices on consumer goods. Its online store can afford to operate on razor thin profit margins because its main business is selling high-profit internet infrastructure, Amazon Web Services. Amazon and other internet-based vendors have caused disinflation in recent years. On January 27, 2021, Fed chairman Powell reiterated that the Fed would tolerate an inflation rate higher than its 2% target. “With inflation running persistently below 2%, we will aim to achieve inflation moderately above 2% for some time so that inflation averages 2% over time.,” he said. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial or tax situation, or particular needs. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. The material represents an assessment of financial, economic and tax law at a specific point in time and is not a guarantee of future results. |