(November 3, 2020, 9:00 p.m. EDT) The Enforcement Division of the U.S. Securities and Exchange Commission released its annual report yesterday. Since it's probably not on your reading list, here are highlights investors need to know.

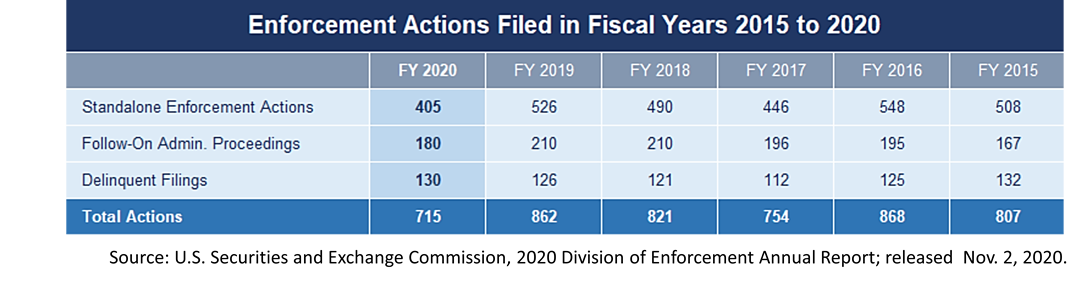

Policing Securities During Covid. "By mid-March, the entire Division had transitioned to mandatory telework and essentially all of our operations were conducted remotely," says Stephanie Avakian, director of the enforcement division at the SEC. An Epidemic Of Fraud. Covid inspired a wave of investment fraud. In March and April alone, the Commission suspended trading in the securities of two dozen issuers where there were questions regarding the accuracy and adequacy of information related to COVID-19 that those issuers injected into the marketplace, including claims about potential COVID-19 treatments, the manufacture and sale of personal protection equipment, and disaster-response capabilities. All told, from mid-March through the end of the fiscal year (Sept. 30), the Division's Office of Market Intelligence triaged approximately 16,000 tips, complaints, and referrals -- a roughly 71% increase over the same time period last year -- and the Division opened more than 150 COVID-related inquiries and investigations and recommended several COVID-related fraud actions to the Commission. A Decline In Total Actions. Understandably, total enforcement actions declined, likely due to Covid. A total of 715 enforcement actions were filed in the 12 months ended September 2020. Taking depositions, getting sworn statements, and related legal procedures were moved online, thereby disrupting investigations and prosecutions of securities crooks. Although total actions declined, stiffer penalties were assessed. "While the number of cases the Commission filed was down as compared to last year, the financial remedies ordered set a new high," according to Ms. Avakian's public letter.

The Bad News For Financial Consumers. A breakdown of the number and percentage of the types of actions brought in Fiscal Year 2020 is bad news for investors. The agency took enforcement actions against half as many investment advisers and mutual funds as in FY2019. The SEC data lumps together investment advisors serving individuals with companies managing mutual funds. These are two critical sources of financial advice and the plunge in enforcement actions is renewed cause for concern. Consumers saving for college education, retirement, or their heirs should be aware of the sudden plunge in policing by regulators. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial or tax situation, or particular needs. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. The material represents an assessment of financial, economic and tax law at a specific point in time and is not a guarantee of future results. |