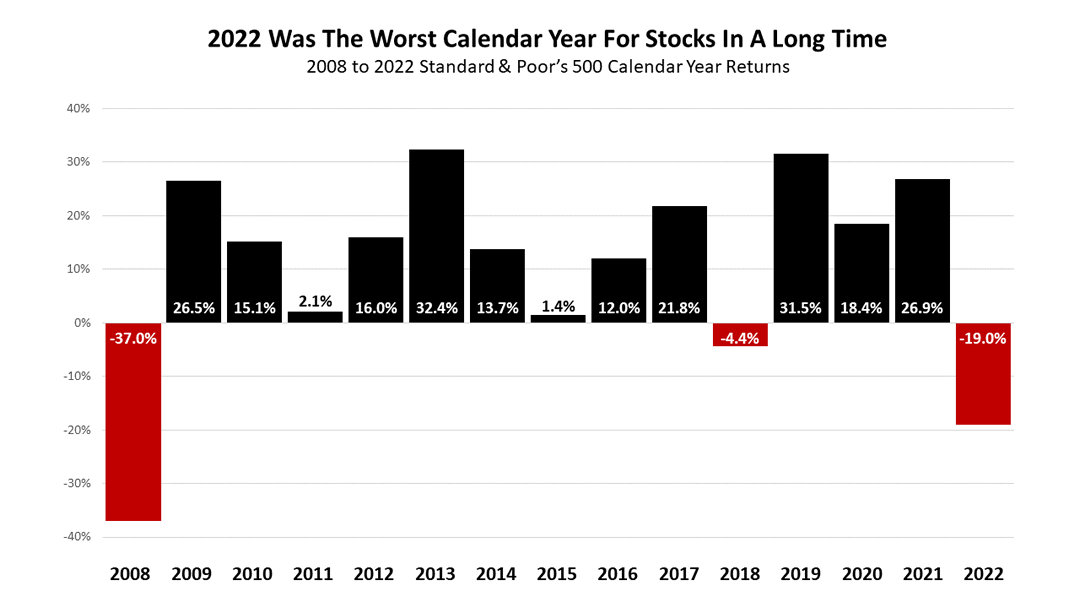

Be glad 2023 is upon us. The stock market closed 2022 with its worst loss since the global financial crisis of 2008. ​ Here’s our final; weekly investment update for 2022.

2022 will be recorded in financial history as the year inflation soared unlike anything experienced since the early 1980s. Consumer buying power shrunk and declined sharply as income levels failed to keep up with price hikes. The Federal Reserve hiked interest rates to halt economic growth and carried out one of the most aggressive monetary tightening campaigns in U.S. history. ​ Supply-chain problems related to the pandemic, along with higher energy prices caused by Russia’s war on Ukraine, sparked the inflation crisis of 2022.

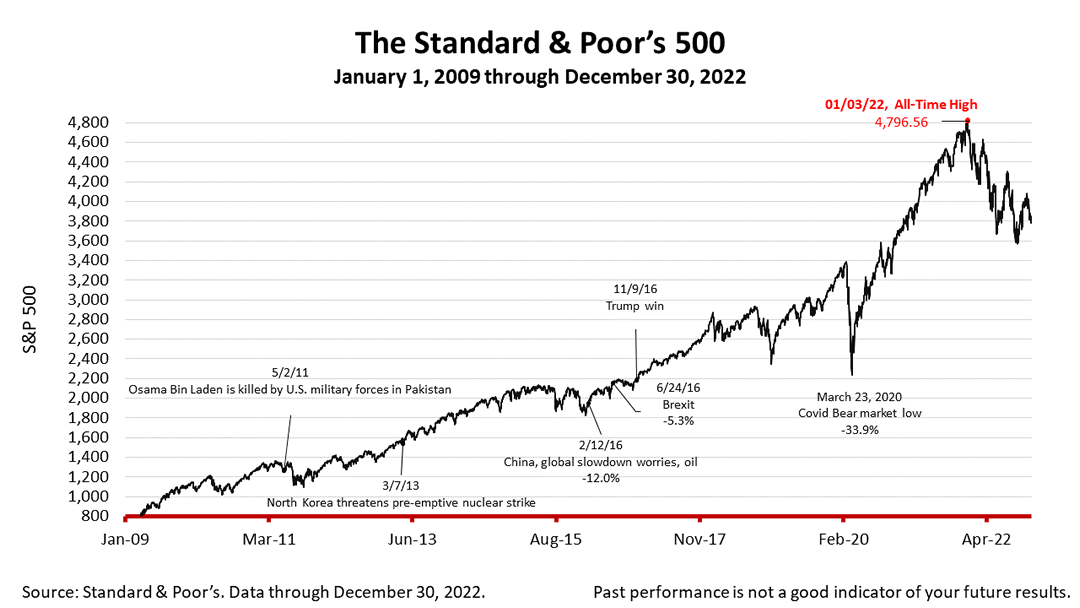

The S&P 500 stock index closed the tumultuous year with a whimper on Friday, at 3,839.50, losing -0.25% from Thursday, and -0.14% from a week ago. The index is up +71.6% from the March 23, 2020, bear market low that followed the pandemic and nearly -20% lower than its January 3, 2022, all-time high. ​ Stocks are just one asset in a diversified portfolio, but they are a key growth asset in building wealth for investors. Along with investing wisely, building wealth requires tax and financial planning. ​ Wishing everyone a healthy, happy, and prosperous 2023! ​ ​ The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |