As data on U.S. economic growth for the second quarter trickles in over the next month, signs that a recession is already under way may emerge. The economy is on the cusp of a recession. The economy shrunk by -1.5% in the first quarter of 2022 and the second quarter could be negative and, thus, begin a recession officially. However, some very key fundamentals remain positive and indicate a recession could be short and shallow.

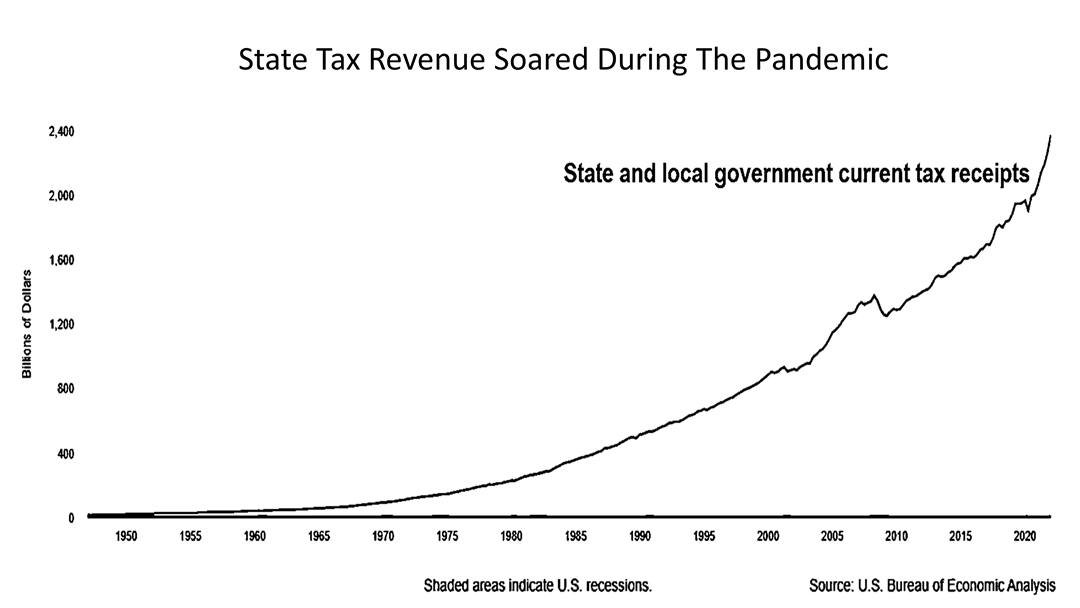

State are flush with cash. State and federal tax receipts are larger than expected. States revenue has soared during the pandemic, as a result of federal stimulus programs. States are able to spend and hire.

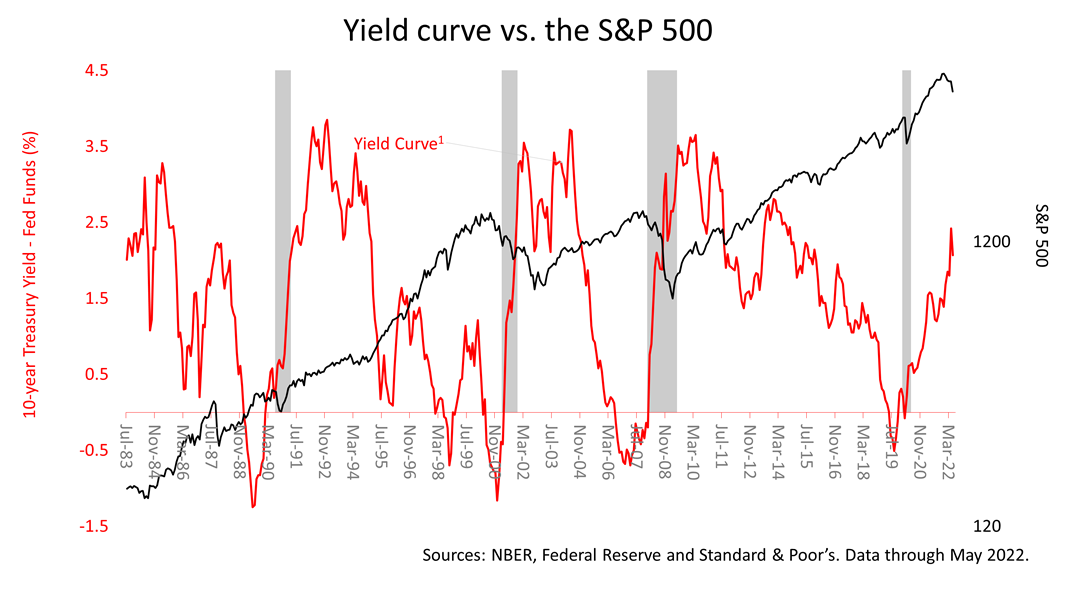

The yield curve remains steep. The yield curve is the difference between the long-term interest rate on the 10-year Treasury bond and the short-term rate on the Fed Funds Rate, which is equivalent to about a 90-day U.S. Treasury Bill. The financial media almost always depict the Fed Funds Rate as the two-year Treasury Note versus the 10-year Treasury Bond, but the Fed and leading professional economists say the Fed Funds Rate is a better indicator of a recession. When the yield curve has inverted the economy has usually turned down into recession with a lag of a year or more. That is not happening now. The yield curve is very steep, still. “Historically, it's taken an inverted yield curve to cause a recession,” says economist Fritz Meyer. “You can see in the red data series here, a curve that inverts means that short-term rates equal or exceed long-term interest rates, and that causes the red line to go negative. And that has preceded each of the last recessions and bear markets, and it's been an infallible indicator. “Yet, today, we have a bear market even as the yield curve is very steep, says Mr. Meyer, “It is odd that we have a very steep yield curve, even with a bear market in stocks.” Mr. Meyer, a former senior investment strategist for one of the world’s largest investment companies for over a decade before going independent, says this downturn is different from others in this respect.

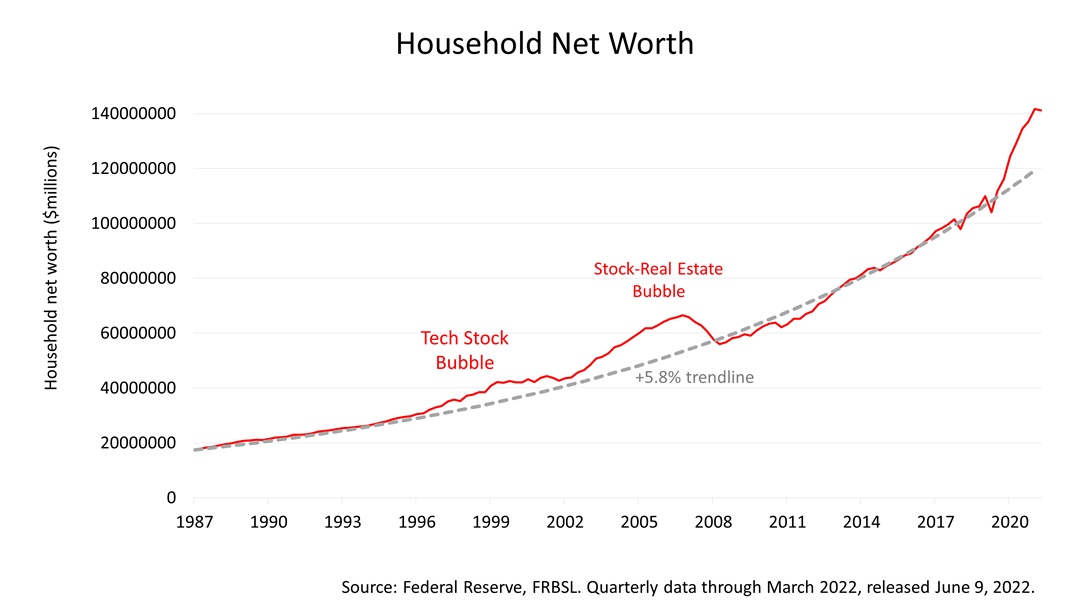

Household balance sheets are exceptionally strong. Household net worth is higher and has surged like it's never done before. This suggests underlying support for continued consumer spending, even if we have an economic slowdown.

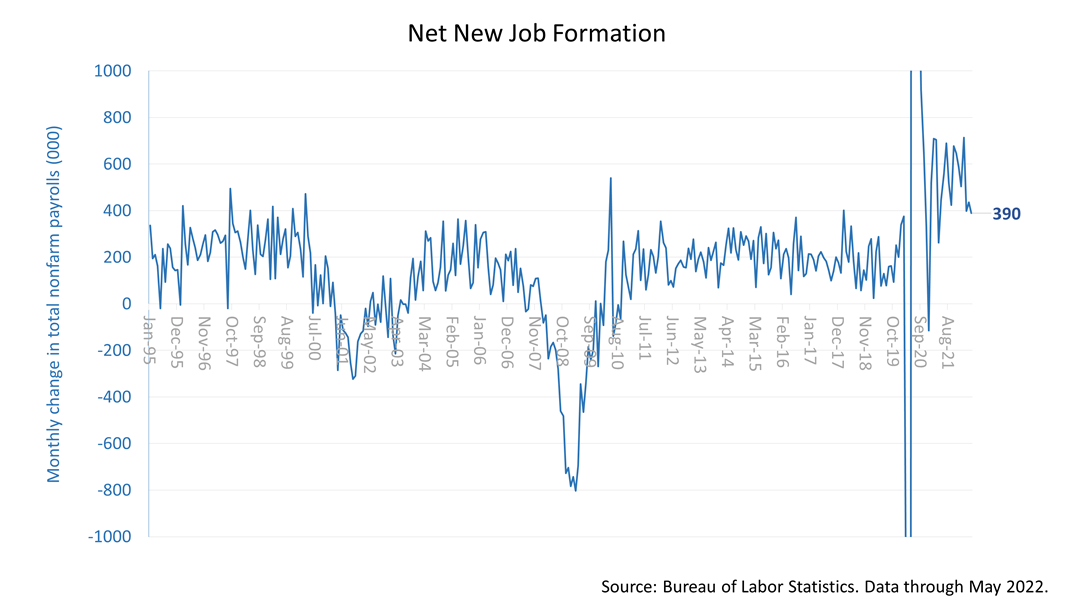

The economy created 390,000 new jobs in May, a very strong number. Putting more people to work, and earning more disposable personal income leads to more spending, which leads to GDP growth. Consumer spending drives GDP growth for the most part, and that starts with new jobs.

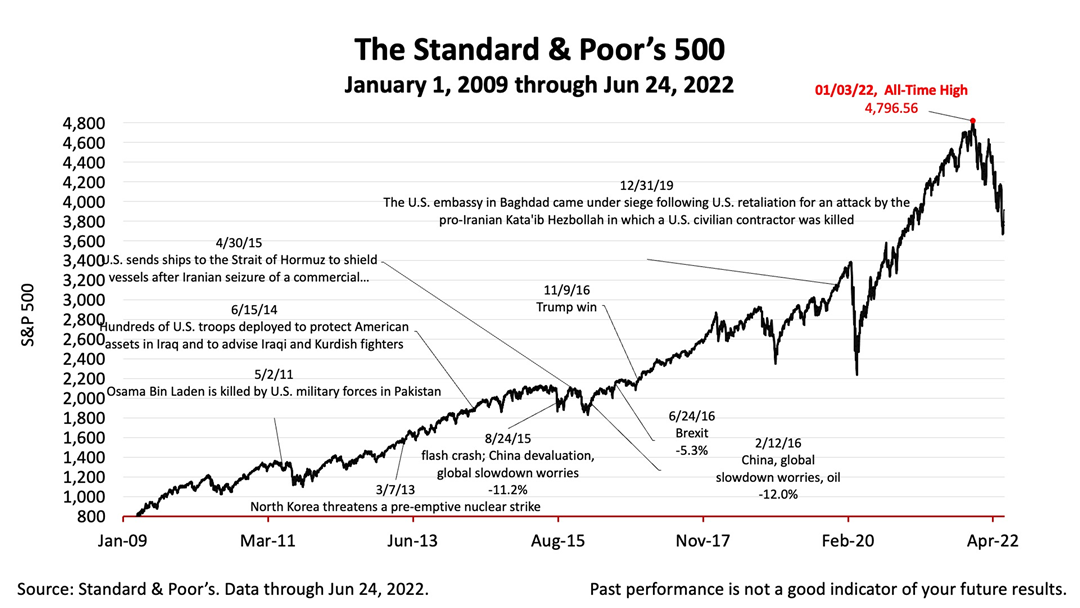

The Standard & Poor’s 500 stock index closed this Friday at 3,911.74. The index gained +3.06% from Thursday and was up +6.24% from last week. The index is up +54.45% from the March 23, 2020, bear-market low, and it is -20.32% lower than the January 3rd all-time high. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |