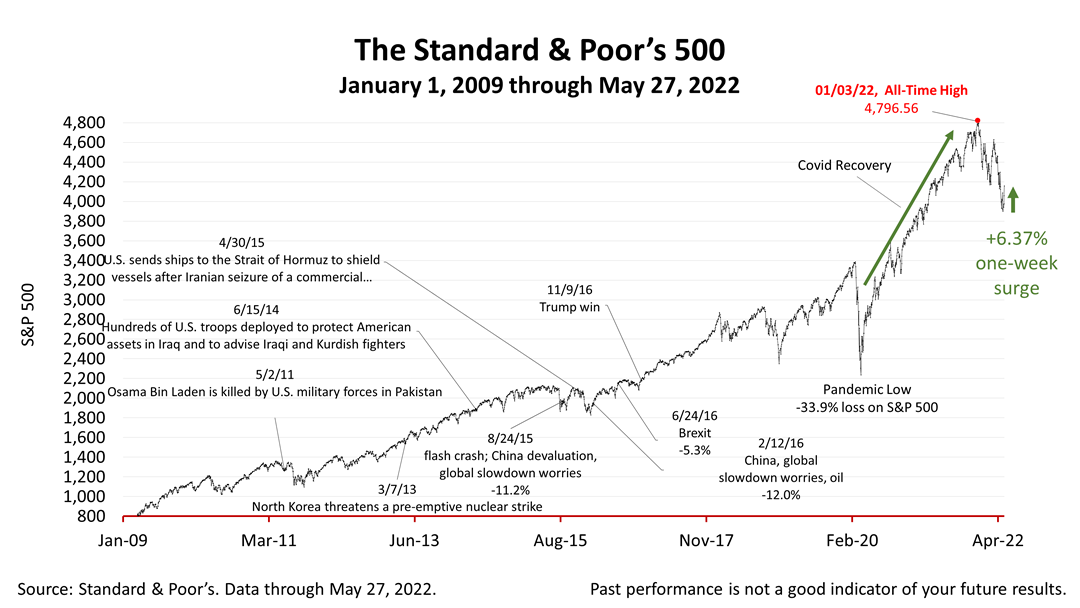

Back from the brink of a bear market, the stock market snapped its seven-week losing streak. The Standard & Poor’s 500 index of blue-chip publicly-held U.S. companies gained +6.37% this past week.

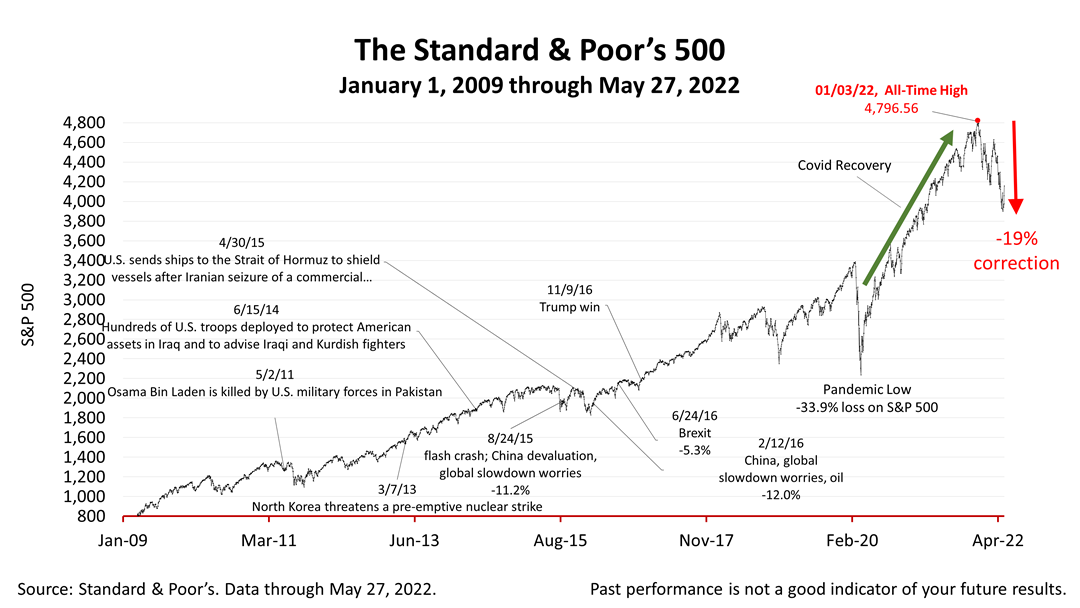

Just a week ago, the S&P 500 was down -19% and in the throes of the worst losing streak since 2001. However, according to consensus forecasts of economists, the U.S. is expected to grow by more than +2% in 2022.

Newly released data on the Federal Reserve’s preferred indicator of inflation, the personal consumption expenditure deflator, indicated inflation eased. In April. Though inflation remains near a 40-year high, strong earnings reports, along with the slowing of inflation, propelled the Standard & Poor’s 500 stock index to close at 4,158.24. The index gained +2.47% from Thursday. The S&P 500 index is up +60.06% from the March 23, 2020, bear market low and down -14.25% from the January 3rd all-time high. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances.

The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |