Positive reports on corporate earnings, housing starts, and the index of leading economic indicators (LEI) drove stocks to close the week at a record high. American Express, Coca-Cola, and Twitter, all issued better than expected earnings reports, and two important economic indicators were very positive.

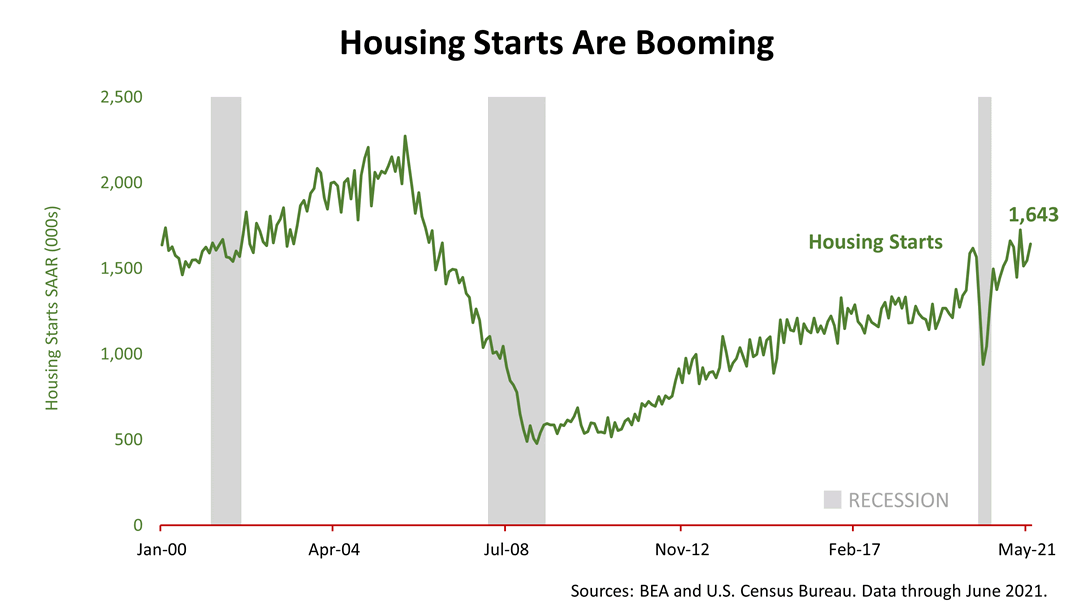

According to numerous academic studies, America needs to build about one million new single-family housing units to keep up with population growth but lagged from that level for five years, from 2008 until 2013. Since June 2020, housing starts have exceeded the one-million a year mark for a sustained period for the first time since 2007. Housing starts are important because they affect a broad range of services and products.

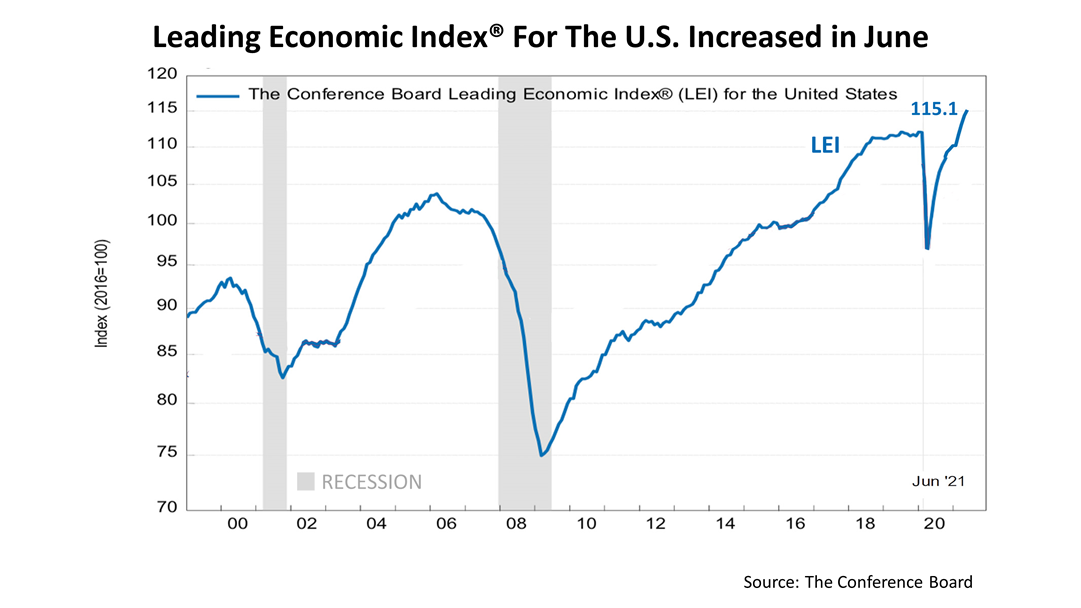

The Conference Board LEI for the U.S. increased by seven-tenths of 1% in June to 115.1, following a +1.2% increase in May and a +1.3% increase in April. The LEI is comprised of 10 sub-indexes, making it an important indicator of what’s happening now in the economy. The LEI is higher than it was at the peak of the last economic expansion at the end of 2019. Keep in mind, the Delta variant is likely to dampen growth but the LEI is higher than it’s been over the past two decades – a very positive sign. “June’s gain in the U.S. LEI was broad-based and, despite negative contributions from housing permits and average workweek, suggests that strong economic growth will continue in the near term,” said Ataman Ozyildirim, senior director of economic research at The Conference Board. “While month-over-month growth slowed somewhat in June, the LEI’s overall upward trend—which started with the end of the pandemic-induced recession in April 2020 — accelerated further in Q2. The Conference Board still forecasts year-over-year real GDP growth of +6.6% for 2021 and a healthy +3.8% for 2022.”

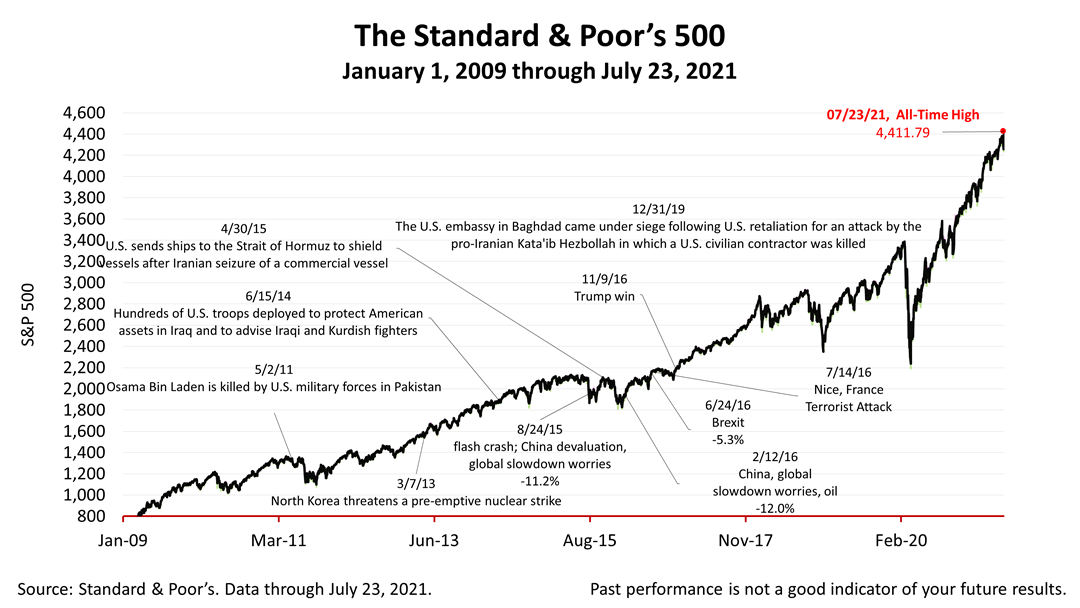

The Standard & Poor’s 500 stock index closed this Friday at an all-time high of 4,411.79. The index gained +1% from Thursday and +2% from a week ago. The S&P 500 is up +65.40% from the March 23, 2020, bear market low. On Monday, the S&P 500 plunged 1.6% after bad numbers were released about Delta variant cases rising in states with low vaccination rates. The Delta variant and inflation remain the main known risks affecting stock prices. Despite the record highs, expect more volatility, up and down, as the nation works its way through this crisis. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |