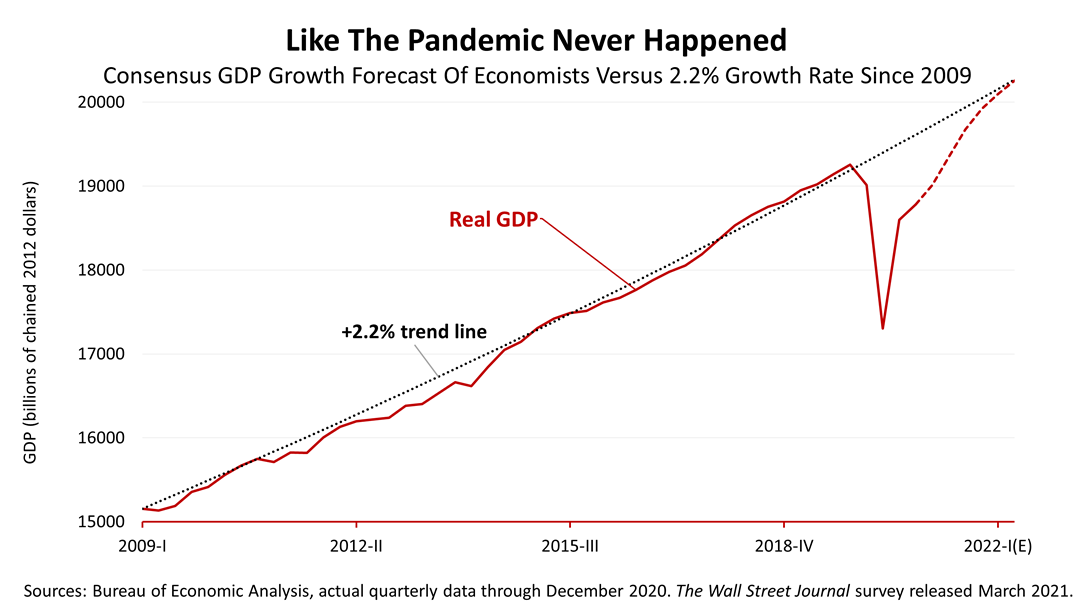

Economic expectations have improved almost overnight. By mid-2022, expect a full economic recovery in the U.S., as if the pandemic was just a bad dream.

The dotted gray line illustrates that the GDP would be about $1 trillion more than it is today, if the pandemic never happened and the economy had continued to grow at the 2.2% average annual growth rate of the pre-pandemic 128-month expansion that began in March 2009. The solid red line shows the actual growth rate, including the unprecedented recession, recovery through the end of 2020 and the dotted red line shows what’s expected to happen by the 60 leading economists polled monthly by The Wall Street Journal.

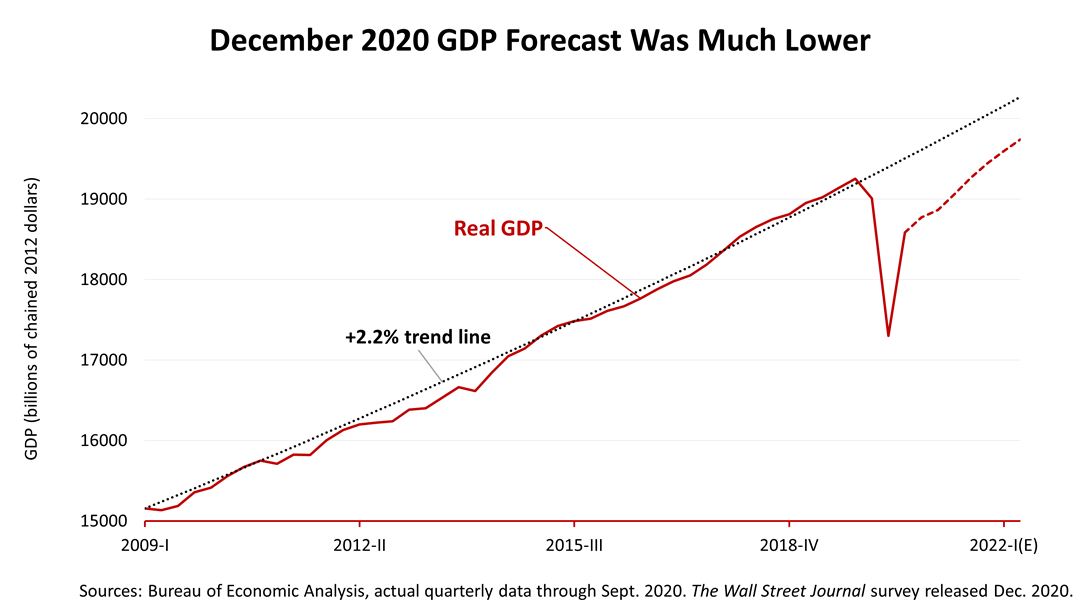

Just three months ago, when the December survey of economists was published by The Journal, the consensus forecast, shown in the dotted red line, was far below a full recovery to the pre-pandemic level of gross domestic product (GDP).

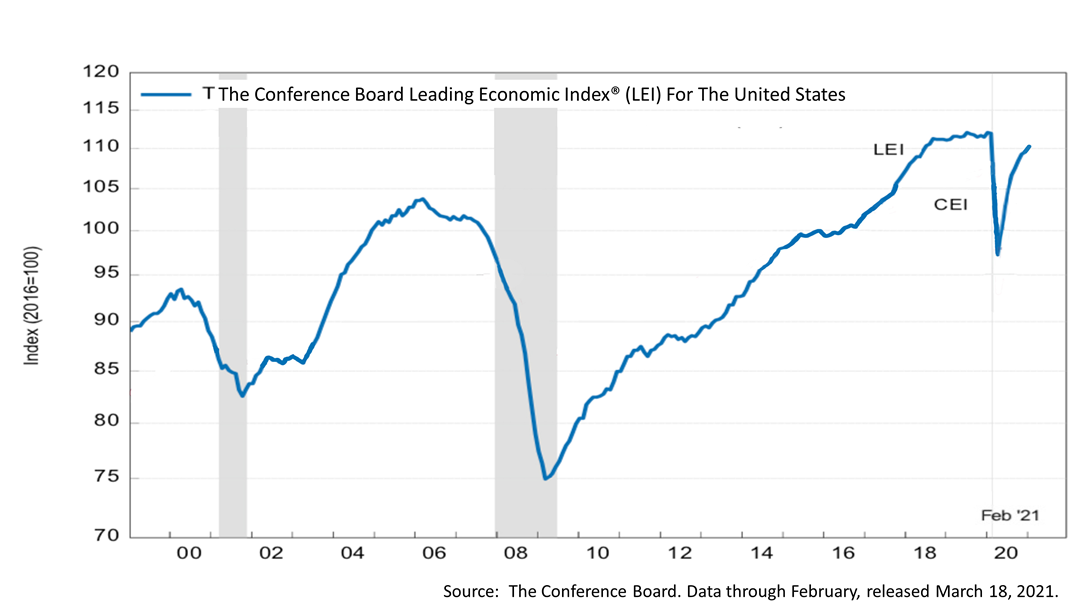

Vaccines, federal government stimulus, and strong economic data seemingly changed the economic outlook overnight. The leading economic indicators (LEI), released yesterday, increased by +0.2% in February, following a +0.5% gain in January, and a +0.4% rise in December. “The U.S. LEI continued rising in February, suggesting economic growth should continue well into this year,” said The Conference Board, an association for big businesses that tracks the 10 components of the LEI. “Indeed, the acceleration of the vaccination campaign and a new round of large fiscal supports are not yet fully reflected in the LEI. With those developments, The Conference Board now expects the pace of growth to improve even further this year, with the U.S. economy expanding by 5.5% in 2021.”

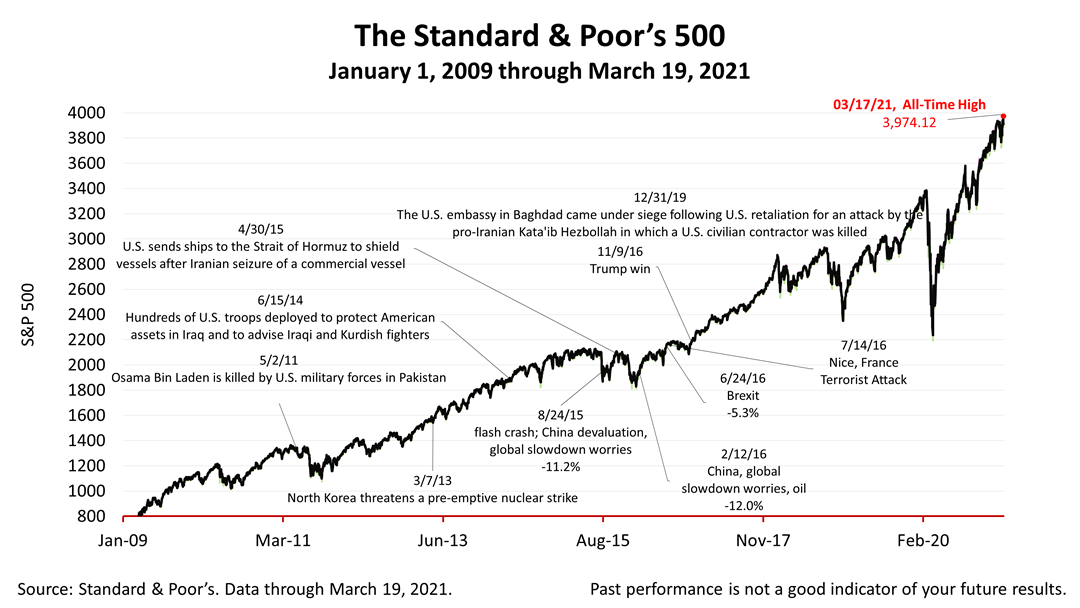

The economy is recovering from the Coronavirus nightmare much faster than had been expected, stocks trade at near record high prices, and it’s not hard to imagine that stock prices will continue to rise. However, unexpected events could quickly dim the currently bright outlook. In addition, taxes are almost certain to be hiked this year on individuals with taxable estates of $3.5 million or more, and high-income earners -- with more than $400,000 of income -- are likely to be hit with a 6.4% federal tax hike. Professional tax and financial planning advice is more important. The Standard & Poor’s 500 stock index closed Friday at 3,913.10. The index lost -0.06% from Thursday and -0.76% from last week, but up +54.48% from the March 23rd bear market low. Expect volatility and consider how you might capitalize on big drops in stock prices. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |