New retail sales and housing data released by the government for January confirmed the recovery is rolling along, on the cusp of the expected enactment of a huge new stimulus and relief package. The stock market declined for the week and the U.S. landed a new robotic rover on Mars on Thursday, to study whether the barren red planet was ever home to life. This week’s financial news highlights the uneven pace of progress in our world.

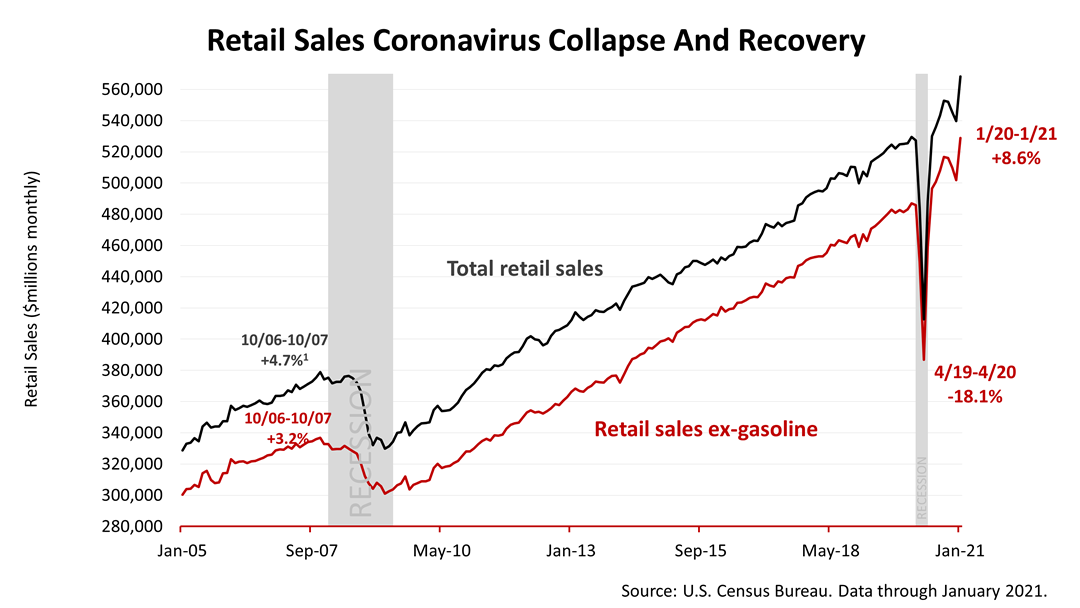

The U.S. Census Bureau reported an unexpected surge in retail sales in January. January’s retail sales soared +5.3% from December. Excluding gasoline -- because its price is so volatile that it often distorts the trend – retail sales soared +8.6%. Retail sales account for 30% of the U.S. economy.

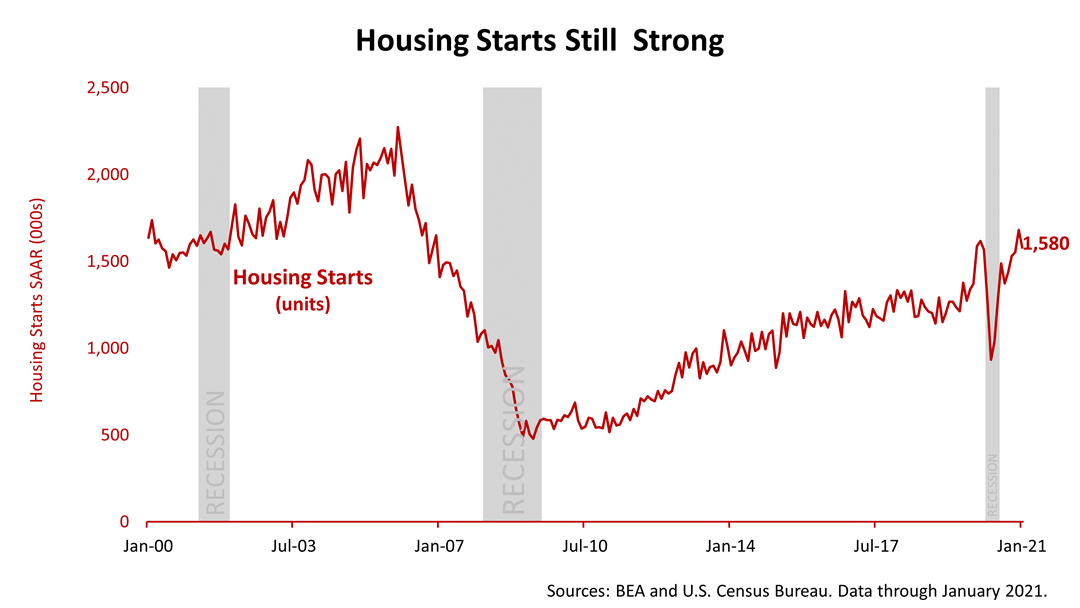

Housing starts, another influential fundamental of economic growth, fell slightly in January from December, but remained at a strong level. In addition, housing permits – an indicator of what’s ahead – were very strong, at 1.88 million. The U.S. needs about 1.7 million housing starts annually to keep up with population growth and immigration.

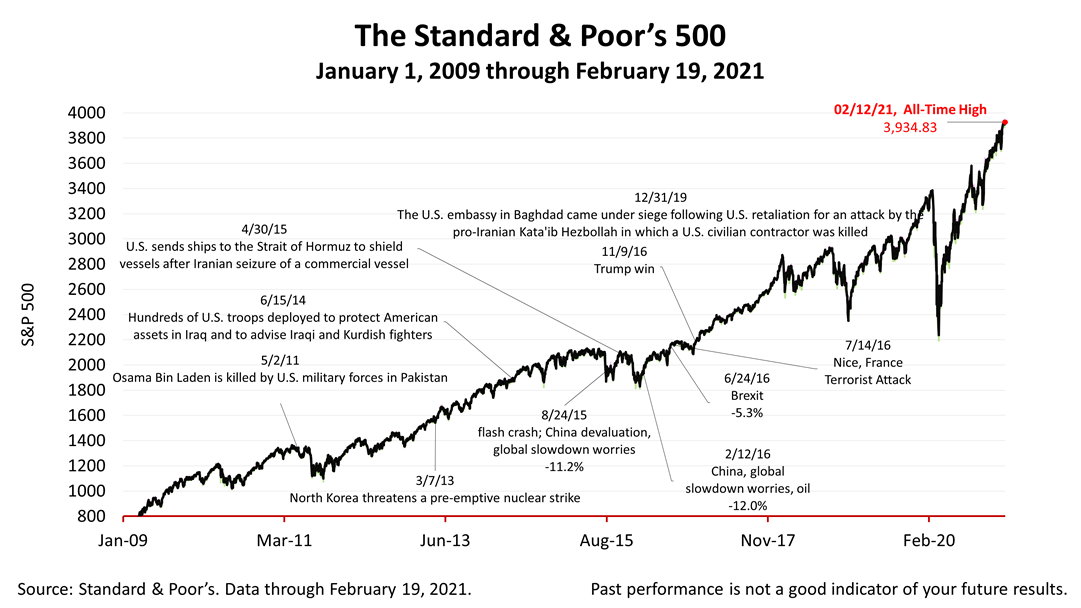

The Standard & Poor’s 500 stock index closed Friday at 3,906.71, a fractional decline of -0.19% from Thursday and -0.71% from last week’s closing price. The S&P 500, a proxy for the growth of the world’s largest economy, is worth +54.3% more than at the Coronavirus bear-market low of March 23, 2020. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice. |